Wednesday, December 27, 2006

Investment club for San Mateo

6:30 pm, (sharp)

393 Vintage Park Dr.

Suite 220

Foster City, CA. 94404

Map: http://tinyurl.com/yesb95

We are starting a PennyJar Investment Club in San Mateo and we would be thrilled to have you join us to find out more about what PennyJar is all about! Our first meeting is January 8, 2007. The location has lots of free parking and is easy to get to; just off highway 92.

Why US $ is going down: Central Banks buying Euros

Below is excerpt from news today

Reports that the United Arab Emirates would diversify its foreign currency reserves by purchasing more euros provided the currency-moving catalyst. Traders viewed the move as symptomatic of a wider trend and quickly bid up the euro.

"By itself, the UAE's shift is small change in the foreign-exchange market," Tony Crescenzi, chief bond market strategist at Miller Tabak and a RealMoney.com contributor, wrote in a published article. But "the UAE's shift is another in a string of actions taken by the world's central banks" to diversify away from the dollar.

source: the street.com http://www.thestreet.com/_iwon/markets/metals/10329783.html?cf=WSIWON1111051500

Saturday, December 09, 2006

Friday, December 08, 2006

Someone tried to Scam me on Craigslist

Then I got this email, which smelled very bad to me:

Hi Paul,

How are you doing.Hope everything is going fine on your side, As a matter fact the deal is on and according to my secretary,he has already sent the check out to you.So the payment should arrive in a short while from now.And once you get it,i guess you know how to handle everything.And please dont bother about any other buyers.But there was a little problem which i guess we can handle with understanding.When i contacted my secretary to know maybe the payment as already been sent,i got to know that there was a misinterpretation while sending the payment.According to the instruction i gave him,he was suppose to have send you a check of $140.But instead,he sent a check of $1400. It was a terrible mistake and the check is already out for delivery to your location.But that should not disturb our own transaction.the deal is on and we will get through it.what will happen is that ,once you get the check you will take it to the bank and cash it immediately,then you deduct your $140, and a $25 dollars for your run around in cashing the check and also a $100 for sending the rest funds to my mover via western union money transfer that same day,my mover will be using the remaining funds for the pick up,i guess i can be assured in you that you can handle it with trust and have it sent to my mover.E-mail me back immediately to let me know that i can trust you to handle everything well.I will be expecting your e-mail asap.PLS AM PUTTING MY TRUST IN YOU.

Best Regards

and Stay Blessed.

Ken.I went to internet crime complaint center and found a description on COUNTERFEIT CASHIER'S CHECK. Basically, they get victims to wire money overseas via Western Union, after they think the check has cleared, but it really hasn't.

Then I called Wells Fargo to get advice on how to proceed, or not. They told me that the scammers work outside the country and they are getting away with it. They referred me to the Internet Crime Complaint Center. Unfortunately, the ICCC only keeps track of victims and are not proactive. They don't actually investigate, only keep statistics. Great.

I cancelled the deal. From now on I deal in cash only.

I can't help but think that a lot of people are falling for this crap.

Friday, December 01, 2006

How the Dollar System works

Thursday, November 30, 2006

Dizzy Dollar Data

In recent days, the "collapse" of the US dollar has been getting some headlines. A benchmark of the dollar is called the Dollar Index. It is an index created by the New York Board of Trade. It takes a basket of currencies and compares them to the US dollar. These currencies are "weighted", i.e. some have more effect than others on the index.

The currencies, and their respective weightings are:

Euro 57.6%

Yen 13.6%

Pound 11.9%

CAN dollar 9.1%

Swiss Franc 3.6%

Swedish Krona 4.2%

In theory, the NYBOT dollar index is trade weighted. That is to say the percentage of importance on the dollar index is a reflection of trade with America.

Well, I decided to look up the actual trade figures for last year, 2005.

Here's what I found.

- America's biggest trading partner was Canada. Almost $471 billion.

- America's second biggest trading partner was China. About $281 billion.

- All of Euro based Europe was somewhere over $300 billion.

Since the Euro makes up 57.6% of the index, one would think that we are doing a lot of trade with Europe. In fact, only about 11 or 12% of US trading activity is with (Euro) Europe. Canada, despite being weighted at 9.1% actually partners in 17% of US trade.

China isn't on the index. Neither is Mexico, which did over $270 billion in trade with the US. Korea and Taiwan combined did over $124 billion in trade. Also, you guessed it, NOT on the index.

Sweden and Switzerland, who make up 7.8% of the index did less than $39 billion last year, combined. That is a meagre 1.4% of US trade.

Perhaps the headline dollar index should be weighted to actual trade, not tied to some ratios that the NYBOT decides is reflective of the strength of the currency.

Bottom line is that headline numbers are often misleading. The dollar has fallen against the Euro and the Pound, but is that so bad, considering most of our foreign trade is done elsewhere? Maybe it hurts Europe more than America, particularly for tourism, airplanes and BMW's. Just a contrarian's view.

Simpler Times

Really sophisticated “investors” might have used some savings to buy securities, such as bonds or stocks. This was done with the help of a broker/advisor. There were a small number of mutual funds available to invest in. Some people bought investment properties with the intention of collecting rent (as opposed to flipping).

These days, there are so many, many choices for the individual, that it has become almost impossible for the average person to make any sense of it all. Many simply give up and surrender their money to multi-billion dollar management firms, which proceed to make outrageous amounts of profit from the management of your money, while your returns wallow in mediocrity.

Starting in January 2007, Pennyjar will be gathering small groups of individuals together to learn and gain confidence in personal finance and investing. These groups are in the form of an "investment club" but they will be much, much more than that. Our first groups will be in the San Francisco Bay area (since that's where we live).

It is important, to us, for people to be fully engaged in the process. For that reason, we will all have some "skin in the game". As a group we will be investing a small amount of money in real investments, be they stocks, bonds or some other product. Let's say, for the sake of argument, that each individual's minimum dollar comitment will be the equivavlent of about one Starbucks latte per week. Not too much, but it will be enough to make it interesting. The collective group of 10 or so members will decide on where the money gets specifically invested.

Pennyjar doesn't stop at being an investment club. We intend to make this process a lot of fun. By design, our meetings will be entertaining. There will also be a significant degree of social interaction. We are not interested in being a group of experts. Frankly, most of the supposed money "experts" are basically full of shit; they just know a lot of jargon and they know how to confuse people just enough so that they will be intimidated to hand over all thier money.

We are just regular people that want to get ahead and we agree that education and knowledge is the best path there. Better than lottery tickets, Amway, Vegas, dot.com stocks, pre-construction flips, and so on.

We are going to help people to help each other gain the knowledge and, we believe more importantly, the confidence to make good decisions. Pennyjar doesn't have all the answers, but we certainly will generate a lot of questions. And we will have a good time in the process.

We promise.

Sunday, November 19, 2006

How to pick a stock: The BUD example

Let's now turn our attention to analysing aka(understanding) ANHEUSER BUSCH (NYSE:BUD). Let's pretend we know nothing about buying stocks. What would be some of the things we would need to know? Well first what is a stock? When you buy a stock you are buying a piece of a company. Stock gives you partial ownership in a company. You become partners with the company. Your fortunes are tied to the company's success. It only seems logical then that you need to understand the company. Fundamental stock analysis is about understanding the company before you become a part owner in the company. O.K. what would I like to know about the company?

What does it do?

How does it make its money?

Can I go to sleep and know the company will still be there when I wake up?

Is the company profitable? (does it make more than it spends)

Does the company reward the stock holders by paying a dividend?

Who runs the company?

How effectively do the owners spend the stock holders money? Remember companies sell stock to raise money. What they do with this raised money is important to their business and your pockets.

Do we think the stock price will go up or down?

Getting the answers to these questions will help you decide if you should buy BUD.

The best place to look for the answer to our questions is Yahoo Finance. Here is the link to BUD at Yahoo Finance

What does it do? This can be found by clicking on profile link from Yahoo Finance. And here is where we find out that BUD "engages in the production and distribution of beer worldwide". This was not surprise (hopefully). We also find out "The Entertainment segment owns and operates theme parks. The company also is involved in the real estate development business; and owns and operates The Kingsmill Resort and Conference Center in Williamsburg, Virginia".

More I want more.. Let's visit www.hoovers.com to find out more about BUD. From Hoovers we find out that BUD owns a 50% stake in Mexico's top brewer, Grupo Modelo, which makes Corona and Negra Modelo among many other brands.

Let's stop here for now. Please look around the profile link. Can you tell me the name of the CEO and the income of th CEO? How many employees?

To be continued.........

Pardon me I just had a taxable event

Call me crazy, but I recently made an offer on a home in the San Francisco Bay Area. And yes I read the headlines and know there is a decline in the housing market. If you have read my earlier post you know that I am fond of the housing bubble logic presented at patrick.net. The house I made an offer on has been on the market for 6 months. The asking price has dropped $70K over those six months. While I think markets like Las Vegas and Reno will continue to drop in value, I am obviously less confident about bay area prices falling any further. So I made the leap of faith and sold some of my stocks to come up with the down payment. The selling of my stocks is a taxable event. I had to decided which stocks to sell. I basically broke my choices into two categories.

Call me crazy, but I recently made an offer on a home in the San Francisco Bay Area. And yes I read the headlines and know there is a decline in the housing market. If you have read my earlier post you know that I am fond of the housing bubble logic presented at patrick.net. The house I made an offer on has been on the market for 6 months. The asking price has dropped $70K over those six months. While I think markets like Las Vegas and Reno will continue to drop in value, I am obviously less confident about bay area prices falling any further. So I made the leap of faith and sold some of my stocks to come up with the down payment. The selling of my stocks is a taxable event. I had to decided which stocks to sell. I basically broke my choices into two categories.- Losers that I have held for less than a year

- Winners that I have held for more than a year.

Why?

If you've held a stock for at least one year, you're eligible for long-term capital-gains rates. Long-term capital gains are taxed at the 20% rate for most folks, while short-term gains--or gains made on stocks held for less than one year--are taxed at ordinary income tax rates, which range from 15% to 39.6%. In my case I am in the 33% tax bracket. So by selling the winners I have held for a year or more I am saving about 13% in taxes compared to selling winners I have held for less than a year. "begin sidebar" see the potential tax draw backs of day-trading? "end sidebar" I decided to sell the losers I have held for less than a year so that I can claim the losses on this years taxes to help offset some of the gains. If my offer is accepted on the home, I will not enjoy the mortgage interest deduction until I do my 2006 taxes.

Wednesday, November 15, 2006

Who owns stock

That said, does it really make sense to point at rich folks and blame them for your own current condition? Rather than blame, my strategy is to ask, "What are they doing?" and then do some of it. Blaming, or being a victim is disempowering. I find it more energizing to take some personal responsibility and change the habits that do not serve me well.

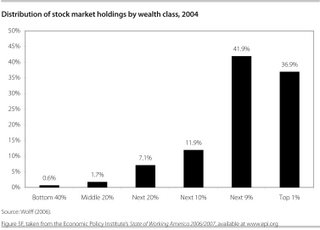

As you can see in the chart below, the top 10% weathiest people in America own roughly 80% of the stocks.

Maybe, if I want to be rich, I should know a little more about investing and stocks.

Maybe I should stop wasting my money on the latest gizmos, fashion trends or bling and put some of that money to work for me.

You think?

Sunday, November 12, 2006

NASD tools: Check your Broker & Mutual Fund fees

Tuesday, November 07, 2006

Mortgage con artists

A lot of ordinary, well meaning folks are being taken to the cleaners by sweet talking con men. The government is trying to crack down, but their results are not very good so far.

Your best defense is knowledge.

Understand the con and render the artist impotent.

"Since the housing market started to soar in 2001, mortgage fraud has become the fastest-growing white-collar crime, according to the FBI. Last year crooks skimmed at least $1 billion from the $3 trillion U.S. mortgage market.This slideshow gives a summary of some of the common cons, including the "Rent to Steal", "Straw man swindle" and the "Million dollar dump".Now that the market is slowing, fraud is only rising. As business dries up, there's increasing pressure on lenders, brokers, title companies and appraisers to be profitable. That means loan and title documents aren't scrutinized as carefully as they might be, and courts - many of them so low-tech they resemble Mayberry - can't keep up with the volume of paper.

Then there's the mad rush to sell, particularly by people who paid high prices for homes and suddenly can't afford the mortgages.

It's like a tasting menu for con artists and grifters, so tempting that in some cities drug dealers have turned to mortgage fraud, plaguing lower-income neighborhoods with crooked mortgages rather than crystal meth."

Friday, November 03, 2006

Put Your Money Where Your Mouth Is

According to WSJ article today:

"It has become easier to know this thanks to a rule by the Securities and Exchange Commission that required fund companies, starting last year, to disclose whether fund managers hold stakes in funds they run. This information can generally be found in a fund's "statement of additional information," posted on a fund company's Web site. The data are given in broad dollar ranges -- specifying only if a manager has invested, say, "$1 to $10,000" in a fund, or "over $1,000,000.""

I went fishing to see how easy it is to get this information. I spent almost an hour on two mutual fund websites and scanned through some prospectus looking for disclosure of managers' "skin in the game".

Alas, I failed, miserably. I will return later to the quest.

Tuesday, October 31, 2006

Simplifying Paperwork

Wall Street Aims to Simplify

Disclosures for Clients

By JAIME LEVY PESSIN

October 31, 2006; Page D2

NEW YORK -- New Morgan Stanley customers will no longer have to read through 14 documents -- amounting to 136 pages -- to get their accounts running. Soon, their financial advisers will hand them a single, 48-page document.

Streamlining efforts like Morgan Stanley's are under way at several Wall Street firms, an acknowledgment that firms -- while satisfying a legal obligation to disclose information -- aren't necessarily informing or educating their customers.

The brokerage industry has an obligation to make multiple disclosures to their clients. Product prospectuses, possible conflicts of interest and the distinctions between fee-based brokerage and advisory accounts, among other things, must be disclosed at various stages of brokerage and advisory relationships.

Bill Lutz, a professor emeritus at Rutgers University who consults regulators and financial firms on incorporating plain language into disclosures, said he has seen companies lose clients because investors were exasperated by the lack of clarity.

Not only do more-understandable disclosures make for better customer service, he said, they reduce firms' liability in cases where customers claim they don't understand what they have signed.

"People have successfully argued, 'We just didn't understand what you were telling us,' " Mr. Lutz said.

Saturday, October 28, 2006

Hacking of online brokerage accounts starts to grow

Foul Fish Report

I subscribe to a couple of financial news mailing list. Everyday my inbox gets filled with the day’s happenings in the world of finance. Unfortunately I am too busy to read these stories everyday and I end up dragging the emails to a “save for later” folder. Today I thought it would be interesting to go through my “save for later” folder of financial news and dig out all the negative stories. I call this inaugural list of wrong doings, “The Foul Fish Report”, in keeping with the Pennyjar little fish vs. BIG fish theme.

I subscribe to a couple of financial news mailing list. Everyday my inbox gets filled with the day’s happenings in the world of finance. Unfortunately I am too busy to read these stories everyday and I end up dragging the emails to a “save for later” folder. Today I thought it would be interesting to go through my “save for later” folder of financial news and dig out all the negative stories. I call this inaugural list of wrong doings, “The Foul Fish Report”, in keeping with the Pennyjar little fish vs. BIG fish theme.Sept. 13 HP CEO Patricia Dunn resigns.

Her efforts to catch boardroom leakers last year led the Palo Alto, Calif., company to hire a contractor that scrutinized the private phone records of H-P's own directors and nine journalists.

Sept. 22 Dead guy gets stock

Cablevision Systems Corp. awarded options to a vice chairman after his 1999 death but backdated them, making it appear the grant was awarded when he still was alive

Sept. 27 Health insurance premiums rise 7.7%

The WSJ reports The average family premium rose 7.7% in 2006. That compared with a 3.8% rise in wages and inflation of around 3.5%.

Oct. 4 Intel investigation.

WSJ reports European Union investigators believe they have enough evidence to pursue formal antitrust charges against Intel Corp., a critical step in their five-year probe of the computer-chip maker, according to two people with knowledge of the case.

Oct. 4 Down on Dunn

HP Chairperson Patricia Dunn was named in felony complaints in California Wednesday along with four others related to a mole hunt undertaken at Hewlett-Packard while she was chairwoman of the computer maker

Oct. 4 401(k) fees too high

St. Louis attorney sued seven big employers-- Bechtel Group, Caterpillar, Exelon, General Dynamics, International Paper, Northrop Grumman and United Technologies--for allegedly allowing their employees' 401(k) plans to be hit with too-high fees, in violation of the Employee Retirement Income Security Act (ERISA).

Oct. 10 Tip of the Iceberg

The Department of Justice has begun an inquiry into potentially anticompetitive behavior among some of the world's leading private-equity funds (WSJ)

Oct. 15 Hey you caught me!

United Health CEO William McGuire plans to retire in the wake of a probe of the company's past stock-options grants. At the end of last year, Dr. McGuire's cache of unexercised options was valued at $1.78 billion. “Hey let me steal $1.78 billion and I would take the punishment of having to retire.” The beat goes on and on with this story. Here is latest list of 120 companies under scrutiny for past stock-option grants

Oct. 20 No bonuses for Costco execs

President and Chief Executive Jim Sinegal and Chief Financial Officer Richard Galanti won't receive bonuses this year.

Oct. 24 Guilty

David Kreinberg pleaded guilty to securities-fraud charges in federal court in New York. The former finance chief of Comverse Technology is the first person to plead guilty in the stock-options backdating scandal.

Oct. 24 Yikes! What happened to FORD?

Ford Motor Co.'s $5.8 billion third-quarter preliminary net loss

Oct. 26 Mutual-fund kickbacks

The SEC has launched a probe of 27 mutual-fund companies that the agency says have accepted kickbacks totaling hundreds of millions of dollars.

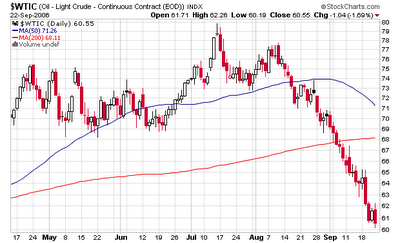

Oct. 26 Slick OIL.

Exxon's profit rose to $10.49 billion in the third quarter, the second-highest quarterly profit ever for a publicly traded U.S. company.

Friday, October 27, 2006

WSJ Piece on Latest Mutual Fund Investigation

After Settlement in Kickback Case

By TOM LAURICELLA

October 26, 2006; Page A1

The Securities and Exchange Commission has launched an investigation of 27 mutual-fund companies that the agency says have accepted kickbacks totaling hundreds of millions of dollars in recent years.

The investigation centers on alleged arrangements in which independent contractors agreed to pay rebates to mutual-fund companies in order to win lucrative contracts for jobs like producing shareholder reports and prospectuses. The probe stems from a $21.4 million settlement the SEC reached last month with Bisys Fund Services Inc., an administrative-services provider owned by Bisys Group Inc.

Regulators say Bisys, which is based in Roseland, N.J., paid a total of $230 million in kickbacks between July 1999 and June 2004 as part of an effort to win work from mutual funds. Bisys settled the civil charges without admitting or denying wrongdoing.

While the alleged kickbacks would have taken only a tiny toll on individual investors, perhaps shaving a few hundredths of a percent a year off their fund accounts and returns, the latest investigation comes as the fund industry is struggling to rebuild its reputation after a series of trading scandals that triggered regulatory crackdowns and fines totaling more than $1 billion.

Critics have long complained about fund companies using shareholder money for their own benefit. For example, funds are allowed to use trading commissions, which are deducted from shareholder funds, to pay for research that may not benefit individual fund investors. They can also levy fees on their investors for marketing, although attracting more investors benefits the fund company and not necessarily its existing shareholders. Both these practices are highly regulated to prevent abuses. Nonetheless, regulators and other observers say the latest scandal is part of a distressing pattern of fund companies misusing shareholder money.

"This is far worse conduct" than previous fund-trading scandals, said Mercer Bullard, a law professor at the University of Mississippi who specializes in mutual-fund matters. "Receiving a kickback that comes indirectly out of the pockets of shareholders is the functional equivalent of embezzlement."

In part based on information from Bisys, the SEC has sent letters to some of the 27 fund companies asking them to provide details about their ties to Bisys, according to people familiar with the probe. They didn't identify any of the companies. However, the investigation is unlikely to include many of the very largest fund companies, which tend to have in-house units that handle administrative functions.

Most of Bisys's clients were bank-run funds, many of which tended to be smaller firms with several billion of dollars under management. A handful of banks, however, do rank among the larger fund managers.

The SEC says the alleged kickbacks involving Bisys and other service providers worked with the help of secret side agreements. The service providers charged shareholder accounts for administrative services but, unbeknownst to the funds' investors or independent board members, the providers agreed to rebate part of that money to fund advisers, who would then use it to cover their marketing expenses. In exchange for the kickbacks, the advisers would recommend to their funds' boards that the service providers' contracts be renewed.

At issue in the probe is whether fund companies misused their investors' money and misled their boards about why they were hiring certain service providers, according to people familiar with the probe. "These matters raise questions about whether there was a breach of duty to shareholders," said Philip Khinda, an attorney who represents a number of fund boards that have been investigating their funds' arrangements with Bisys.

In its complaint against Bisys, the SEC described the actions of one fund company, which it referred to as "Adviser A," that allegedly demanded millions of dollars in kickbacks in return for recommending that Bisys's contract be renewed. Another 26 fund families had similar deals -- some written, and some only oral -- with the firm, the SEC said.

The agency didn't identify any of the fund companies in the complaint but, according to people familiar with the investigation, "Adviser A" is AmSouth Funds, which was then a unit of AmSouth Bancorp of Birmingham, Ala.

AmSouth Bancorp declined to comment on whether or not it is the company referred to as "Adviser A," but it said it is cooperating with the SEC.

In 2005, after the alleged arrangement with Bisys had ended, the AmSouth Funds, which then totaled $5.5 billion in assets, were sold to Pioneer Investments. A spokesman for Pioneer declined to comment.

The SEC's Bisys complaint says a senior executive at "Adviser A" told Bisys in 1999 that if it didn't agree to a kickback arrangement, one of its competitors would. Indeed, the SEC alleged in its complaint that "other administrators" besides Bisys cut such deals.

Bisys's main competitor is SEI Investments Co. A spokesman for SEI, which is based in Oaks, Pa., said that as a matter of policy the company wouldn't comment on whether it had received inquiries from the SEC nor on whether it had similar rebate agreements with fund companies.

Bisys accepted the deal with "Adviser A," and over the next five years, funds totaling $17.3 million were deducted from shareholder accounts at the fund company, according to the SEC. The money was used by "Adviser A" mainly to cover marketing costs that would normally come out of its own pocket. The adviser also used some of the money to pay the initiation fee and monthly dues at a country club, the SEC's complaint says.

In the arrangement with "Adviser A," Bisys would be paid 0.20% of fund's assets, the SEC said. However, Bisys kept only roughly one-quarter of that amount. About one-third was paid to "Adviser A" in an above-board contract, the SEC says, while the remainder was kicked back to the adviser through a "marketing budget."

In its settlement with the SEC, Bisys agreed to terminate such agreements and change its policies. It disciplined or fired a number of employees.

Last summer, AmSouth gave its own version of its dealings with Bisys. At the time, it disclosed that the SEC had informed the bank it intended to bring civil charges against it related to the service provider. It said that the probe related to "past arrangements under which Bisys used a portion of the fees paid to it by the fund family to pay for marketing and other expenses."

The mutual-fund industry has been dogged by scandals in recent years. In 2003, it came under fire after revelations that a number of big companies let favored clients conduct short-term trading, earning profits at the expense of ordinary shareholders. The following year, regulators cracked down on fund companies that used stock-trading commissions, which are deducted from shareholder accounts, to pay for marketing activities the companies would otherwise have had to cover themselves.

Wednesday, October 18, 2006

Brokers cost you Billions

The reports compares the performance of mutual funds bought through a broker compared to funds bought directly. The conclusion is that, through brokers, "consumers pay extra distribution fees to buy funds with non-distribution expenses. The funds they buy under perform those in the direct channel, even before deductions of any distribution related expenses."

Statistics don't lie. The statistics say that, by using a broker, you are

1. paying higher sales fees

2. to buy funds with higher management fees

3. that get crappy returns.

The crappy returns cost investors approximately $9 billion per year, and that is not including distribution expenses.

Why is this happening?

I go to the section 9, titled "Do Brokers Merely Sell what they are Paid to Sell?

Here, the authors refer to the obvious hypothesis that "brokers may give priority to their self-interest or to the interests of the management companies whose funds they sell."

The statistical evidence indicates that higher fees paid to brokers result in higher sales for the mutual fund paying the fee. According to the report, "These results suggest that sales incentives are more effective in the broker channel, consistent with the old saw that funds are sold, not bought - and that paying a salesforce on a higher piece-rate scale may induce additional sales"

Ultimately, all the fees and commissions come from the investors. Your money.

Do you know what you are paying in fees?

Do you know how much of your money your broker is getting?

Coming Up Short

• Over the past 10 years, owners of diversified U.S. stock funds collected 7.3% a year, less than their funds' 8.8% published return.

• In 19 stock markets, investors underperformed a buy-and-hold strategy by 1.5 percentage points a year since 1973.

• Over seven years, broker-sold stock funds lagged behind directly sold funds by half a percentage point a year after expenses.

Sources: Morningstar Inc.; academic studies

Tuesday, October 17, 2006

130/30

Let's start at the beginning. The "Alpha".

I am not referring to the first letter of the alphabet or the biggest gorilla in the troupe. In finance, alpha has a different meaning.

It is a measure of how well an investment, usually a mutual fund, performs in comparison to the overall market. In an oversimplified example, if the whole market goes up 10% and your specific investment goes up 10%, then the alpha of that investement would be zero.

Things get a little more complicated because Alpha also considers the relative risk of whatever stocks are being bought. If a fund manager invests in stocks that are very stable (i.e. prices don't fluctuate too much), the alpha is calculated differently than if the fund manager invests in very volatile stocks.

Conventional wisdom states:

Stable stocks are safer - volatile stocks are riskier.

Therefore, if one invests in risky stocks, the potential profits should be higher. Alpha takes that into consideration. A mutual fund specializing in nanotechnology start ups would have to deliver much higher profits than a collection of blue chip mega-corporations to get the same "alpha" ranking.

So, getting back to 130/30. The goal is to increase the alpha while maintaining low volatility. It works like this:

Let's assume $100 investment.

1. Buy $100 of large cap stocks

2. Sell short $30 of the stocks in your portfolio

3. Take the proceeds of the short sale and buy more large cap stocks.

Confusing? Just a bit. Selling short is like betting that a share price will go down. How this is achieved can be complex and possibly another post on the blog. These days, shorting often involves trading of options and derivatives. The important thing to know is that the more a stock falls, the more profit the investor makes.

The tacit assumption is that the managers of the 130/30 fund are good at picking winner and loser stocks. Ultimately, that is going to determine performance.

The cool thing is that this strategy limits losses when markets turn downward. This is how risk is reduced, without sacrificing performance. It could limit profits in a crazy bull market. But in the long race, it is often profitable to bet on the tortoise, not the hare.

Monday, October 16, 2006

Hedging Stocks

Alternately, they have entrusted their public retirement benefits, namely social security and medicare, to the government. The government has mismanaged these programs and now finds itself with trillions of dollars of unfunded liabilities, going forward. (i.e. the system is headed for bankruptcy)

Hmm. Stock market and government. Who should we trust less?

I would contend that people can, really and truly, only depend upon THEMSELVES. To trust politicians and Wall Street sharks to take care of your money has got to be the height of mass gullibility. Ordinary people learning to take care of their own financial lives is why we started Pennyjar. It's not as complicated as the "experts" would have you believe; and it can be fun, with the right approach.

But I digress.

It is quite true that one can become very wealthy through owning stocks, but for the majority of us, it simply has not come true. So many ordinary people lost money in the dot.com bust. So many ordinary people have watched their mutual fund based retirement portfolios wallow in mediocrity since the bull market ended in 2000.

So who is really making money with stock?

In very basic terms, there is a class system in play in this country.

The working class has basically nothing. They are living paycheck to paycheck and are prisoners of debt. They are depending on social security and medicare to take care of them after they finish working. There are some uncertain times ahead for this group of 50 million or so unfortunate Americans. Fact of the matter is that they may not be able to retire and will probably have to keep working to make ends meet, until they cannot.

The middle class has invested trillions of dollars in mutual funds, most of them invested in a basket of US stocks. When stocks go up, they win. When stocks go down, they lose. Very simple game. Of course, the brokers, investment advisors, mutual funds, corporate executives and tax man all win, no matter what. All the risk of loss is in the hands of the individual holding the stocks (i.e.: YOU).

The rich are a very different story. The rich, that is to say, people with a liquid net worth of more than a $ million, are able to be designated as “Accredited Investors” and can invest their money in “private equity funds”, often better known as hedge funds. They, like the middle class, buy stocks with the anticipation that they will go up in value. Unlike the middle class, however, rich investors also may have a percentage of their investments configured so that if stock prices drop, they also make money. This is known as hedging and is where name “hedge funds” originated.

So what can you do if, like most ordinary people, you don’t have over a million dollars available for investing? To begin with, it is possible to do some hedging of your own.

There are some relatively new products available. Some in particular caught my eye recently. They are newer mutual funds utilizing a 130/30 strategy. It is a strategy that hedges against stocks going down and is available for ordinary people. The managers of these funds "short" 30% of theirs stocks. I will post more on 130/30 strategy later.

There are also some relatively new ETFs (exchange traded funds) that are engineered to move inversely with the market. That is to say, if the market drops, the ETF goes up. If the market goes up, the ETF goes down.

Using hedging as a strategy is most certainly not good for everyone. But it is an option, and it is utilized by a lot of very rich people, so there must be something in it.

Sunday, October 15, 2006

San Mateo County: Renters beware!

Friday, October 13, 2006

Market Madness

Never mind that the previous record was in January 2000 dollars. Inflation eaten up 15% (or more, unless you actually believe the government inflation numbers).

Never mind that the US dollar is worth 30% less in the world now than in 2000.

The fact of the matter is that the market index is reported in "nominal" dollars. It doesn't take into account the lower purchasing power of dollars today as compared to seven years ago.

If you had left your money in cash from 2000 to today, you would be up almost 21%.

Even accounting for dividends paid by Dow companies, this investment is barely break even for 7 years.

Since many ordinary investors buy the Dow through mutual funds, they are getting additional fees removed from their holdings, year after year after year. Over the 7 years, mutual fund fees of 1.5% would have removed another 10% from your nest egg.

Thursday, October 12, 2006

You are responsible for your retirement, not your company

There was a time in American when it was not usually to work your entire life for one company and then retire with the security of knowing that every month a company retirement check would show up in your mailbox. As I am sure you realize those days are long gone. Outsourcing, mergers and overseas competition have changed the landscape of the America workforce. I work in IT and recent studies have shown that on average folks change companies every five years in IT.

Gone too are the days were a company would provide a pension plan to its employees. With a company pension plan every employee knew exactly how much money they would have when they retired. The companies funded the pension plan and the employee was not responsible for making any investment choices. The company took care of it all. When you retired you would get a retirement check for the REST OF YOUR LIFE.

Can you image the dismay felt by thousands United Airline workers when their company declared bankruptcy and was allowed by the courts to default on billions of dollars of employee retirement money? This is just one of several recent examples where company funded pensions have failed. The mantra of this posting is “you are responsible for your retirement”.

Most companies have shifted from company funded pension plans to 401(k) retirement plans. With these plans employees put a portion of their earning into tax-deferred investments. Sometimes a company will match a portion of the dollars the employee contributes. The two big differences between a traditional company funded pension plan and a 401(k) are:

- You are not guaranteed a retirement check for the rest of your life.

- The company provides a selection of investment choices and it is up to the employee to research and understand the investment choices.

You are responsible for your retirement, not the company. You, not the company, need to make sure you are not living in a run down apartment and eating canned food when you are 70 years old.

You need to save and invest for your retirement NOW. Time is your enemy. Now is the time to start taking responsible and learning about your 401(k) investment choices. Now is the time to start putting money aside each month to make investments. You need to make your money work for you now or you have no chance of enjoying the 20 or more years you expect to live when you retire.

As the first step I urge, beg and implore you to watch the PBS Frontline documentary entitled Can you afford to retire?. You can veiw the show for free online. The instructions state that you need Microsoft media player or Real Player. I cound not play the show using Media Play, but was able to using Real Player. If you do not have the time or bandwidth to watch the show online you can visit your local library and see if they have a copy.

The picture in this posting is meant to be distrubing I want you to seriously think about where you will be 10 years after you retire. Example: my rent is $1,000/month and my food bill is about $500/month. So food and housing is $1,500/month for me.

I want to live and have fun for at least ten years after I retire. How much do I need? $1,500 X 12 = $18,000 per year

10 years = $180,000

Now this is very basic and actually $180,000 won't even come close to being enough money to live on for ten years. The key is learn about investing and start making your money grow now. This is the only way to increase your chance of having the retirement you have dreamed of. Now go watch the video. Check back in at Pennyjar and let's learn together how to invest wisely.

Monday, October 09, 2006

Why Pay Commissions

Today, zecco.com debuted commission free stock trading.

$2,500 minimum balance

40 stock trades per month

Zecco makes money through advertising on the site, interest on cash balances and margin accounts and charges for some other things like options trading.

Zecco is a kind of stylized mesh of the words: Zero Commission Online

Thursday, October 05, 2006

Direct stock purchase programs

- McDonald (nyse: MCD)

- Walt Disney Co. (nyse: DIS)

- Intel (nasdaq: INTC)

- CVS (nyse: CVS)

O.K. now I have shown you a real life example of how you can join the big fish and own stocks for as little as $25/month. Believe it or not that is the easy part. My question to you is "So is (NYSE:BUD) a good stock to purchase? Is this stock right for your investment portfolio?" Yes that's right now that you can join the game you need to learn to play the game. Stay tune to PennyJar in the weeks to come I as we take a closer look at our bud-light friend and see if it is the kinda stock we think will make us some money

Stock Picking

Wednesday, October 04, 2006

Discretionary Income : choose your path

Let’s start of by defining discretionary income. It is a big word but a pretty basic concept. Discretionary income is defined as the amount of an individual's income available for spending after the essentials (such as food, clothing, and shelter) have been taken care of.

This basically means taking care of your needs before you worry about your wants. Now we have all been in situations where we have had to choose between what we need and what we want. For instance you need to pay your mortgage or rent but you want to take a vacation. You cannot have both and as grown ups we understand that we need to pay the rent and delay the vacation. Part of growing up is learning how to delay gratification and developing a sense of self-worth. How well we develop these two behaviors goes along way toward satisfying our basic needs and clarifying our wants from life.

The choices we make with our money are inexplicably tied to our behavior. Noted psychiatrist Dr. William Glasser developed “Rational Choice Theory”. Rational Choice theory postulates that people calculate the likely costs and benefits of any action before deciding what to do. The benefits of taking a vacation do not exceed the cost of losing a place to live. Like Maslow’s hierarchy of needs, Rational Choice theory believes humans are driven by the basic need for survival and the psychological needs of belonging, power, freedom and fun. So discretionary income is the money we have after we have taken care of our basic needs and is used to satisfy our psychological needs of belonging, power, freedom and fun. So once we have some "extra" money our goal should be learning how to effectively utilize discretionary income toward a better life. How does one effectively utilize discretionary income toward a better life? The first step is to understand the choices you have with discretionary income. To illustrate this I have created a road map named the Money Quadrant. Its purpose is to show the four basic paths you can choose with your deiscretionary income.

- Shopping

- Saving

- Gambling

- Investing

With wealth you will more often do things because you want to not because you have to.

Sunday, October 01, 2006

ETF vs.Traditional Mutual Funds

ETFs advantages over Mutual funds.

- Lower expense ratios

- Price set throughout the day. Thereby eliminating the possibility of illegally timed trading.

- Tax advantages from low turnover

Types of ETF | Average Expense Ratio % |

| U.S. Equity ETF | 0.39 |

| International ETF | 0.68 |

| Fixed Income ETF | 0.17 |

| Traditional Actively Managed U.S. Equity Fund | 1.48 |

| Traditional Actively managed International Equity Fund | 1.75 |

| Traditional International Index Fund | 0.84 |

| Traditional Actively Managed Taxable Fixed income fund | 1.13 |

| Traditional Index Taxable Fixed Income Fund | 0.49 |

The downside to ETFs is that because they are traded liked stocks they are subject to transaction fees. The advantage that ETFs have in lower expense ratios can be negated by active trading of ETFs. Because of this it is often recommended that ETFs be bought in bulk rather building up a position by continually buying shares. Also some ETFs are narrowly focused and as such become volatile for example the iShares MSCI Netherlands Index NYSE:EWN mirrors the Dutch stocket martket index (MSCI). It is has a YTD return of 19.49% contrast this with Internet HOLDRs (HHH) at -(25.37%) YTD.

As for me I recently sold some poor performing stocks (held less than a year) and bought an ETF that tracks GOLD. I believe that the USD is going to continue to lose value against other currencies. This is a discussion for another time. If you are looking for a cost efficient alternative to mutual funds now is the time to consider buying an ETF. For starters compare iShares S&P 500 to mutual funds that track the S&P 500.

Friday, September 29, 2006

Mortgage Fraud Bilked Victims Out of Millions

There are predators out there who are very slick.

PLEASE! don't sign anything unless you know exactly what it is, or you may unknowingly be on the hook for big bucks.

From AP

INDIANAPOLIS (AP) -- The nation's largest home lender, Countrywide Financial Corp., is suing an Indianapolis man for allegedly orchestrating a mortgage fraud scheme in which dozens of Virginia residents were tricked into buying homes in Indiana at inflated prices.

The Calabasas, Calif.-based company alleges that Robert Penn worked with relatives in Virginia and associates that included appraisers and mortgage companies to defraud the victims in a case that could total about $80 million in loans.

In a lawsuit filed in Marion County, where most of the Indianapolis-area properties are located, Countrywide claims the defendants duped their victims by inviting them to take part in either an "investment opportunity" or a "real estate investment club."

The victims were not required to make down payments or cash contributions.

The suit alleges the paperwork that truck drivers, retirees, factory workers and others in or around Martinsville, Va., signed eventually made them "straw borrowers" liable for bogus loans for one or more homes by submitting false mortgage applications.

The victims were not given copies of the "investment" documents and were rushed into signing them after being told they needed to be quickly delivered to Indianapolis, the lawsuit claims.

"The straw borrowers were not asked to read the documents they signed, and in some cases were told there was no time for such a read, or that it was unnecessary," the lawsuit states.

Tony Pickett, an Indianapolis real-estate agent who's representing 39 of the victims, said the case involves about 400 loans that average about $200,000 each.

According to the lawsuit, Penn, his sister, Sharon Penn, who lives in Martinsville, Va., six other individuals and a number of companies obtained purchasing agreements for Indianapolis-area properties at market value, but then had them appraised at significantly higher amounts.

The court documents contend that the Penns and their associates then bought the homes in the names of the Martinsville residents who had signed the "investment" paperwork giving the defendants use of their names, credit histories and signatures.

The lawsuit alleges that the defendants obtained the properties for an average price of $50,000 but "sold" them to the unknowing victims for an average inflated price of $120,000 each, then pocketed the difference.

Clean Mail

Thursday, September 28, 2006

Unleaded Gas and Elections

Maybe it is just a coincidence that gas prices have dropped right before the election. Maybe it is because hurricanes haven't materialized like expected. Maybe it has to do with a new deep water discovery in the Gulf. I'm just a little fish and I have no way of knowing for sure.

Consider these facts, and make your own conclusion.

Henry_Paulson is the Treasury Secretary, nominated by George Bush. Prior to this position, he was Chairman and CEO of Goldman Sachs.

The Goldman Sachs Commodity Index (GSCI) is an index of 24 commodities and serves as a benchmark for investment in world markets.

Starting this month, the GSCI reduced the weighting of unleaded gas in the index from about 8% to a little over 2%. The press release doesn't explain why.

Institutions such as commodity trusts or mutual funds, who's funds track the GSCI, own a lot of unleaded gas futures. They are required to mirror the weighting of the index with their holdings. To maintain this weighting, they now have to sell billions in unleaded gas futures. Could this cause prices to drop?

Wednesday, September 27, 2006

Leveling the playing field (access to information)

Share Holder Proxy Statements: Say What?

So in the spirit of "Say What?" Here is the full text of the basic description.

In general terms, the transactions contemplated under the securities exchange and distribution agreement, which we refer to as the proposed transactions, involve the transfer by Fidelity National Financial, Inc., which we refer to as FNF, to us of substantially all of FNF’s assets, other than its ownership interests in FNT, FNF Capital Leasing Inc., a wholly owned subsidiary which we refer to as FNF Leasing, and Fidelity National Information Services, Inc., which we refer to as FIS. These assets include FNF’s interests in various subsidiaries, up to an aggregate of $275 million in cash and certain investment assets and any other property or rights that FNF owns immediately prior to the closing under the securities exchange and distribution agreement. In consideration of the contribution of these assets by FNF, FNT will, with certain limited exceptions, assume all of FNF’s liabilities and issue shares of FNT Class A common stock to FNF.We refer to this contribution of assets by FNF to FNT in exchange for the assumption of liabilities and issuance to FNF of shares of FNT Class A common stock as the asset contribution. Immediately following the asset contribution, FNF will convert all of its shares of FNT Class B common stock into shares of FNT Class A common stock and then distribute all of the shares of FNT Class A common stock that it owns, including the converted shares and the shares received from FNT pursuant to the securities exchange and distribution agreement, to holders of FNF common stock as a dividend, which we refer to as the spin-off. As a result, FNF stockholders will receive shares of our common stock representing, on a fullydiluted basis, approximately 85% of our outstanding common stock. After the completion of the spin-off, FNF will have no assets other than its approximately 50.5% ownership position in FIS, its ownership of FNF Leasing and its rights under certain agreements entered into pursuant to the securities exchange and distribution agreement.

Additionally, our certificate of incorporation will be amended to, among other things:

• increase the authorized number of shares of FNT Class A common stock from 300 million to 600 million;

• eliminate the FNT Class B common stock and all provisions relating thereto;

• remove all references to and any requirements resulting from FNF’s ownership of FNT common stock; and

• change our name to “Fidelity National Financial, Inc.”

We refer to the amendments to our certificate of incorporation as the charter amendments. Further, we will amend the FNT 2005 Omnibus Incentive Plan, which we refer to as the omnibus incentive plan, to increase the number of shares available for grants thereunder by 15.5 million. Following the completion of the proposed transactions, our common stock will be listed and traded on the

New York Stock Exchange, which we refer to as the NYSE, under the symbol “FNF.”

Tuesday, September 26, 2006

We Want Our Money Back!

Suits Claim Excessive 401(k) Fees at 7 Firms

By Kathy M. Kristof Times Staff Writer

September 26, 2006

Seven of the nation's largest companies violated pension laws by allowing their employees to be overcharged by the outside firms running their 401(k) retirement plans, according to a series of civil lawsuits.The employees were charged millions of dollars in excessive management fees, which often were hidden in obscure agreements and not disclosed to the workers, the suits allege."At best, these fee structures are complicated and confusing when disclosed to plan participants," claim all the suits, which were filed this month by attorney Jerome Schlichter in federal district courts in Illinois, California, Connecticut and Missouri. "At worst, they are excessive, undisclosed and illegal."

"In its Retirement at Risk series last spring, The Times reported that hidden fees were quietly eroding the 401(k) nest eggs held by 44 million American workers, and that many companies pay little attention to the costs. Employee benefits experts say suits targeting 401(k) costs are rare but could become more common as companies increasingly scale back their traditional pension plans — making earnings from 401(k)s more crucial

In 401(k) plans, employees contribute a portion of their earnings to an investment fund, often with a matching contribution from their employer. The employee is typically given the option of investing in a variety of mutual funds, which charge fees to invest and manage the money.

The lawsuits focus on so-called revenue sharing deals, in which the mutual funds chosen for corporate 401(k) plans return a percentage of the management and investment fees they earn to the outside administrators who run the plans and determine which funds will be offered.

These revenue sharing arrangements were not disclosed to participants, the suits allege, and the costs charged for them have far exceeded what is reasonable to manage the accounts.

Shareholders Want More Say

Boards of Directors are supposed to represent shareholders. There is a valid perception by many small fish shareholders that public companies are often controlled by an "Old boy network" who are less than diligent when looking out for the small investors. Sometimes these boards are referred to as "lap dogs".

When proposals like this get publicized, the company spokespeople usually try to argue that the shareholders interests wouldn't be served if a shareholder's representative was nominated. Okay.

Wall Street Journal, Sept 26, pg A2:

"Hewlett-Packard Co. should overhaul its board in the wake of the leak-investigation scandal, corporate-governance experts say, and four public pension funds are proposing a way for shareholders to help do that.

The four funds -- representing public workers in Connecticut, New York, North Carolina and Washington, D.C. -- said they filed a proposal asking H-P to change its bylaws to allow any shareholder group holding 3% of the company's stock for at least a year to nominate one or more board candidates.

Backers of the proposal are the New York State Common Retirement Fund, the Connecticut Retirement Plans and Trust Funds, the North Carolina Retirement Systems and the American Federation of State, County and Municipal Employees Pension Funds. Their proposal relies partly on a recent appeals court ruling that sided with AFSCME."

Monday, September 25, 2006

Teachers getting squeezed

It seems that "one" of the reasons for the county budget short-fall was a lawsuit won by commercial property owners. The commercial property owners claimed their taxes were too high when compared to business loss from 9/11. Not sure how that works. Are commercial property taxes tied to business revenues? Will have to find info on the lawsuit. Generally speaking what is going to happen to entities that depend on property taxes when property values go down? The news is full of stories about a housing slowdown. Anyways here is link to full story. Again need to find out more about lawsuit

Saturday, September 23, 2006

Living Small

Automobiles:

It is no longer trendy to drive an SUV.

Housing:

Sales of McMansions have rolled over.

Mark Vassallo, author of "The Barefoot House" says: "In a lot of cases, houses are not fitting the way people live anyway. People feel isolated from each other. We're all only so big, and human scale is so important. We won't find such a shock upon shifting to a smaller house if we admit we need one good space to watch TV, perhaps not three."

Food:

McDonalds stopped supersizing two years ago. More restaurants are offering smaller or half portions.

Friday, September 22, 2006

A Mutual Fund Fee That Is Actually Good

Market timing involves having favored investors rapidly trading in and out of mutual funds to profit from price differences. This hurts long term shareholders by diluting shares and increasing management fees.

The 22c-2 rule is designed to create a financial penalty for Sharks trying to profit at the expense of long term shareholders. It directs the mutual fund boards (who are supposed to be looking out for the shareholders) to consider imposing a "redemption fee" of up to 2% on any redemptions that take place within one week of buying the shares. Since nearly all long term investors will hold shares for longer than one week, they will not have to pay this fee. Actually, any proceeds of the fee are paid to the other shareholders.

According to today's Wall Street Journal, at least one third of mutual funds will not ready to meet all the requirements of 22c-2. They are having trouble with the requirement to have written agreements with brokers to receive information about potential short term trading.

So there are a few kinks; but overall this is a positive step forward for the average mutual fund shareholder.

Thursday, September 21, 2006

Who Is Charles Ponzi, and Why Do I Care

This is Charles Ponzi.

This is Charles Ponzi.He was born in Italy in 1886. He arrived in the U.S. in 1903 with $2.50 in his pocket.

He was one of the greatest swindlers in the history of the United States; and that is saying a lot.

If there were a Con-man Hall of Fame, he would be it's Babe Ruth.

His name has become synonymous with a particular type of scheme that is as popular today as it was in Ponzi's heyday, if not more so.

So, why should I care? Because running a Ponzi scheme is very, VERY lucrative for the perpetrator. It prays on people's greed and love of fast, easy money. The problem is that most of the people that get lured into these schemes get burned. They lose money. And in the end, they feel duped. There are countless variations on the Ponzi or Pyramid scheme. It is related to the greater fool theory.

You WILL be exposed to Ponzi schemes. There are new ones being created all the time. It is very tempting to get sucked into them because it appears to be easy money. It almost certainly is not, unless you are on the inside (in which case you will likely go to jail and pay it all back, if caught). Do yourself a favor and go to Vegas instead. At least they take your money legally.

The Ponzi scheme works like this (from museumofhoaxes.com):

"A Ponzi, or pyramid, scheme involves luring in investors with promises of high returns. The con artist makes up some story to explain how the high returns are generated, but in reality he simply pays the first investors with money obtained from later investors. It's a take-from-Peter-to-pay-Paul system. As long as the scam artist manages to recruit larger and larger numbers of new investors (aka suckers) it'll work, but as soon as the flow of new money stops, it collapses. And Ponzi schemes always collapse, sooner or later.

Ponzi's bait to lure in investors was the idea that postal coupons purchased in Europe could be redeemed in America for six times their value, because of the difference in currency values. He established a company in late 1919 to take advantage of this discovery and invited people to invest with him, promising them that his scheme was so lucrative that they would double their money in ninety days. On paper Ponzi's postal-coupon idea was plausible. But in practice his idea was completely hare-brained. It would have involved teams of agents buying up postal coupons in Europe, shipping them to America, and then taking them down to the post office to redeem them, one at a time. The cost of paying all these agents would quickly have eaten up any profits. Plus, for his idea to work he would have needed to redeem millions of postal coupons, but there were only a couple thousand of them in circulation.But, of course, Ponzi had no intention of actually putting his idea into practice. He just wanted as many people as possible to give him their money, and then let the pyramid scheme system go into effect.

And give him their money they did. At first people were skeptical, but when he actually began paying out returns to the early investors, a Ponzi-mania set in. Everyone wanted to give him their money. Thousands of people were lining up to give him cash. It's said that he had over 40,000 investors, allowing him to rake in somewhere in the region of $15 million by mid 1920.The inevitable crash arrived later in 1920 when newspapers and banks started to investigate him. Rumors of his criminal past emerged. Investors panicked and began withdrawing their money from his company. This caused the entire scheme to come crashing down like a house of cards.

Oddly enough, Ponzi didn't simply take the money and run. If he had been smarter, he would have. Instead he waited around until the police arrived and ended up being sentenced to five years in jail, of which he served three-and-a-half years.Ponzi spent the rest of his life drifting in and out of trouble with the law. He died in Rio de Janeiro on January 18, 1949, penniless."

Monday, September 18, 2006

Gimme What You Got

You can arm yourself, alarm yourself

You can arm yourself, alarm yourselfBut there's nowhere you can run

'Cause a man with a briefcasecan steal more money

Than any man with a gun

I said gimme, gimme what you got

-Don Henley

The cost of stock options is paid by shareholders of a company. The shareholders pay the cost with the understanding that these rewards motivate the management and employees of a company to perform well. It is a win/win scenario, in theory.

Options give their recipients the right to purchase shares at a fixed price, usually the market price on the date of the grant. Backdating involves pretending that a grant was made earlier than it really was, when prices were lower.

Here's the scam. Let's say I am CEO of UnitedWealth, Inc., and I am granted an option for 10,000 shares. Today's stock price is about $50. But instead of setting the price at today's market price, it is set to the price last June, when it was $40. My options are already $10 "in the money", before I even start. That is $100,000 bonus for doing nothing.

Stock options backdating is a way of skimming more profits away from shareholders.

Here is the list of 115 companies currently under scrutiny for stock option manipulation. If you own mutual funds or other pooled assets, or your retirement fund owns equities, it is possible you own some of these stocks and that these theives were taking money from your pocket without you even knowing about it.

Today's news:

Wall Street Journal, Sept 20, page A17

Monster Worldwide Inc. suspended its general counsel and Broadcom Corp.'s finance chief retired ahead of schedule, as the fallout from the options-manupulation scandal continued to spread.

Both Monster and Broadcom have disclosed problems with their stock-options accounting. Earlier this month, Broadcom doubled its estimate of the hit to its books, suggesting it will make a restatement to increase its past expenses by more than $1.5 billion.

In a short statement, Monster said lontime general council Myron Olesnyckyj was suspended "effective immediately" though it didn't say precisely why. Broadcom said William J. Ruehle "decided to accellerate his retirement".

At many companies, general councels are responsible for supervising aspects of the options-granting process, while finance chiefs typically supervise how grants are accounted for.

Saturday, September 16, 2006

Who Pays the Piper?

Awarding options is a way to motivate employees and managment to work extra hard to make a company profitable. More profit=higher stock price=higher option value. On the surface, this makes sense. Work hard, perform, deliver results, reap rewards. Everyone wins!

So how does it work?

Let's say, for example that I work for Giggle (the purely fictitious Internet search company), and two years ago and I was awarded 10,000 stock options at the price of $120 per share. I don't actually buy the shares; I have an option to buy them at a set price, within a specified time period. Using a complex Giggle algorithm, it quickly becomes obvious to me that every dollar increase in the price of the stock puts $10,000 in my pocket. If the stock goes down in price, I lose nothing. Overall, there is no risk for me.

So two years go by, during which I have worked many hours and helped Giggle to dominate the Internet advertising space. All this accelerating ad revenue has caused the stock price to skyrocket to $420, so I decide to exercise my option. I buy 10,000 shares at $120 per share and simultaneously sell those 10,000 shares at $420 per share. My net profit is $3 million, less transaction fees and taxes. Yee-ha!

So where does that $3 million come from?

Good question.

To give someone something, it is usually necessary that you own it. Therefore, the company, Giggle in this case, needs to actually own some of it's own stock to sell to me. If they don't own stock, they would have to buy some at the market rate.

Option 1:

Already own the stock.

Giggle takes shares that it could sell on the open market for $4.2 million and sells it to me for $1.2 million. Net result is that I am $3 million richer and the company is $3 million poorer.

Option 2:

Have to buy stock.

Giggle buys stock for $4.2 million and sells it to me for $1.2 million. Net result is that I am $3 million richer and the company is $3 million poorer.

Now $3 million may sound like a lot of money, but Giggle has 300 million shares outstanding, so it is really only about a penny per share. Small price to pay for all that increased motivation and performance. But wait a minute, you may ask. What if Giggle has 1,000 employees, each with 10,000 options. That works out to $3 billion in payouts. That seems a bit excessive, doesn't it?

Well, the shareholders are in luck. There is a highly qualified Board of Directors looking out for the shareholders interests! The Board would never stand for excessive spending on stock options. They say "Options are good. Besides, our competitors are doing it so if we don't join in, all our good managers might go work for Mister Softey or Yoyo". For doing such a good job of looking out for the shareholders, the company issues more options to the directors, which the directors then duly approve.

It turns out that most of the shareholders are mutual funds and institutions. Many individuals own the stock in retirement and investment accounts. They trust the fund managers to look out for their best interests. The mutual funds also have Boards of Directors (affectionately known as "lap dogs") that are diligently looking out for the interests of the individual mutual fund holders.

In a perfect world, the amount a company spends on stock options would be more than offset by increased productivity and performance due to highly motivated employees and company management. When options get out of hand, and greed takes over, it is the shareholders that ultimately pay the price.

Buy real estate with your IRA

What is a self-directed IRA? It's simply an Individual Retirement Account established with a broker instead of a mutual fund or a bank. A self-directed IRA enables you to buy and sell individual stocks, mutual funds and real estate. As a result, you make the investment decisions instead of someone else, such as the manager of a mutual fund.

A great way to get started with a self-directed IRA is to roll over your 401K into a self-directed IRA. You can roll over your 401K when you terminate your employment. So if you are looking to change employers keep in mind this is a wonderful opportunity to roll your 401K into a self-directed IRA.

For me buying real estate is the most appealing aspect of a self-directed IRA. Remember banks, brokerage firms, and other companies that administer most IRAs are not interested in helping folks buy real estate because they want to sell their own products. About 10 years ago I changed jobs and decided to open a self-directed IRA. My motivation was to take care of my disabled brother. My goal was to purchase home for my brother. There are some restrictions about who can be the owner of property bought through a self-directed IRA. For instance the following would be excluded from owning real estate under and IRA.

- The IRA owner

- The IRA owner's spouse, descendant (e.g., son), or ascendant (e.g., mother)

- Spouse of a descendant of the IRA holder

I shopped around for an IRA custodian that offered self-directed IRA. Ten years ago the pickings were pretty slim. I decided to go with a Pensco because they were local (San Francisco) and I really like the way they answered my questions and their supporting documentation. I ended up rolling my 401K into a self-directed IRA help by Pensco. I bought my brother a home in North Carolina and can now sleep a little better at night knowing my brother will always have a roof over his head.

Conclusion: There is a reason your IRA has limited investment choices. There is an alternative and it is called a self-directed IRA. With a self-directed IRA you can buy real estate today with tax deferred dollars. I encourage you to read up on the self-directed IRAs.

NYSE Targets Brokers & Supervisors

"Now, we're beginning to focus on the individual brokers who were facilitating

market timing of customers, and we're looking at supervisors of those

brokers,"GO MS. MERRILL!

The mutual fund market timing scandal first came to light in 2003 and has resulted in settlements, before the Prudential settlement, of more than $3.5 billion. Market timing costs long term holders of mutual funds through dilution of share value and increased transaction costs.

Following is an edited copy of the NYSE news release

NEW YORK, August 28, 2006 – NYSE Regulation, Inc. announced today that it has censured and ordered Prudential Equity Group, a member firm, to disgorge $270 million for fraudulent market timing in connection with the trading of mutual fund shares.

“It is absolutely unacceptable to see the level of knowledge and acquiescence by senior managers of such pervasive deception by Prudential’s market-timing brokers,” said Susan L. Merrill, chief of enforcement, NYSE Regulation, Inc. “The disgorgement of $270 million will compensate the funds’ shareholders. The action is also evidence of tremendous cooperation by securities regulators working together to ensure that a brokerage firm cannot profit from condoning fraud.”

Prudential has been ordered to pay a total of $600 million. $270 million will be paid to a distribution fund administered by the SEC for the benefit of those harmed by the fraud, $325 million will be paid to the U.S. Department of Justice, and $5 million will be paid as a civil penalty to the Massachusetts Securities Division. “Market timing” includes frequent buying and selling of shares of the same mutual fund or buying or selling of mutual fund shares in order to exploit inefficiencies in mutual fund pricing. Though not illegal per se, market timing can harm mutual fund shareholders because it can dilute the value of their shares, if the market timer is exploiting pricing inefficiencies, or disrupt the management of the mutual fund’s investment portfolio and can cause the targeted mutual fund to incur costs borne by other shareholders to accommodate frequent buying and selling of shares by the market timer.

To prevent market timing, mutual funds have placed restrictions on excessive trading in their prospectuses and monitor for excessive short-term trading by reviewing brokers’ and customers’ account numbers, trade size, principal amount, and branch codes.

From September 1999 and continuing through at least June 2003 brokers at Prudential used deceptive trading practices to conceal their identities, and those of their hedge fund customers, in order to evade prospectus limitations on market timing. At least 50 mutual funds and their long-term shareholders were defrauded. The firm profited from this misconduct because the brokers generated approximately $50 million in gross commission revenues as a result of this misbehavior.

The deceptive practices included the use of: 1) multiple broker identifying numbers; 2) multiple customer accounts; 3) accounts coded as “confidential”; and 4) “under the radar” trading. The practice of “under the radar” trading refers to the splitting of one trade into numerous smaller ones to avoid detection.

As early as the fourth quarter 1999, several mutual fund companies identified the use of deceptive trading practices and notified Prudential. In May 2002, the firm itself determined that its top-producing broker used deceptive practices to avoid notice by mutual funds. Ultimately, the firm received hundreds of notices from mutual fund companies that identified the misconduct and asked Prudential to take steps to curtail the activity.

Despite increasing awareness of the brokers’ fraudulent activities, the firm elected to continue the business of market timing. Instead of disciplining or sanctioning any of the brokers, or even curtailing their ability to open additional accounts for their market timing customers, Prudential failed to prevent their misconduct from continuing and actually began to track the brokers’ gross revenues.

For example, in 2001, the brokers generated more than $16 million in gross commission revenues for the firm, most of which was in danger of being eliminated had the firm phased out market timing at that time. Similarly, approximately $23 million in gross commission revenues were generated in 2002, and comparable revenues continued to be generated until June 2003.

The firm’s policies and procedures were ineffective and largely not enforced. Even in situations where the firm purportedly enforced any of these policies, its senior officers undermined the policies by granting exceptions for the largest producing brokers. Additionally, Prudential repeatedly failed to prevent the inappropriate use of hundreds of broker identifying numbers, even though the use of multiple numbers was the primary means of concealment by which the brokers carried out their fraud. Prudential finally issued a market timing policy in January 2003, but the firm did not fully enforce procedures in that policy to end the scheming.