Friday, September 29, 2006

Mortgage Fraud Bilked Victims Out of Millions

There are predators out there who are very slick.

PLEASE! don't sign anything unless you know exactly what it is, or you may unknowingly be on the hook for big bucks.

From AP

INDIANAPOLIS (AP) -- The nation's largest home lender, Countrywide Financial Corp., is suing an Indianapolis man for allegedly orchestrating a mortgage fraud scheme in which dozens of Virginia residents were tricked into buying homes in Indiana at inflated prices.

The Calabasas, Calif.-based company alleges that Robert Penn worked with relatives in Virginia and associates that included appraisers and mortgage companies to defraud the victims in a case that could total about $80 million in loans.

In a lawsuit filed in Marion County, where most of the Indianapolis-area properties are located, Countrywide claims the defendants duped their victims by inviting them to take part in either an "investment opportunity" or a "real estate investment club."

The victims were not required to make down payments or cash contributions.

The suit alleges the paperwork that truck drivers, retirees, factory workers and others in or around Martinsville, Va., signed eventually made them "straw borrowers" liable for bogus loans for one or more homes by submitting false mortgage applications.

The victims were not given copies of the "investment" documents and were rushed into signing them after being told they needed to be quickly delivered to Indianapolis, the lawsuit claims.

"The straw borrowers were not asked to read the documents they signed, and in some cases were told there was no time for such a read, or that it was unnecessary," the lawsuit states.

Tony Pickett, an Indianapolis real-estate agent who's representing 39 of the victims, said the case involves about 400 loans that average about $200,000 each.

According to the lawsuit, Penn, his sister, Sharon Penn, who lives in Martinsville, Va., six other individuals and a number of companies obtained purchasing agreements for Indianapolis-area properties at market value, but then had them appraised at significantly higher amounts.

The court documents contend that the Penns and their associates then bought the homes in the names of the Martinsville residents who had signed the "investment" paperwork giving the defendants use of their names, credit histories and signatures.

The lawsuit alleges that the defendants obtained the properties for an average price of $50,000 but "sold" them to the unknowing victims for an average inflated price of $120,000 each, then pocketed the difference.

Clean Mail

Thursday, September 28, 2006

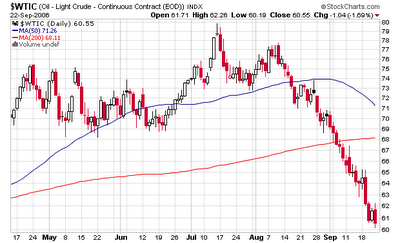

Unleaded Gas and Elections

Maybe it is just a coincidence that gas prices have dropped right before the election. Maybe it is because hurricanes haven't materialized like expected. Maybe it has to do with a new deep water discovery in the Gulf. I'm just a little fish and I have no way of knowing for sure.

Consider these facts, and make your own conclusion.

Henry_Paulson is the Treasury Secretary, nominated by George Bush. Prior to this position, he was Chairman and CEO of Goldman Sachs.

The Goldman Sachs Commodity Index (GSCI) is an index of 24 commodities and serves as a benchmark for investment in world markets.

Starting this month, the GSCI reduced the weighting of unleaded gas in the index from about 8% to a little over 2%. The press release doesn't explain why.

Institutions such as commodity trusts or mutual funds, who's funds track the GSCI, own a lot of unleaded gas futures. They are required to mirror the weighting of the index with their holdings. To maintain this weighting, they now have to sell billions in unleaded gas futures. Could this cause prices to drop?

Wednesday, September 27, 2006

Leveling the playing field (access to information)

Share Holder Proxy Statements: Say What?

So in the spirit of "Say What?" Here is the full text of the basic description.

In general terms, the transactions contemplated under the securities exchange and distribution agreement, which we refer to as the proposed transactions, involve the transfer by Fidelity National Financial, Inc., which we refer to as FNF, to us of substantially all of FNF’s assets, other than its ownership interests in FNT, FNF Capital Leasing Inc., a wholly owned subsidiary which we refer to as FNF Leasing, and Fidelity National Information Services, Inc., which we refer to as FIS. These assets include FNF’s interests in various subsidiaries, up to an aggregate of $275 million in cash and certain investment assets and any other property or rights that FNF owns immediately prior to the closing under the securities exchange and distribution agreement. In consideration of the contribution of these assets by FNF, FNT will, with certain limited exceptions, assume all of FNF’s liabilities and issue shares of FNT Class A common stock to FNF.We refer to this contribution of assets by FNF to FNT in exchange for the assumption of liabilities and issuance to FNF of shares of FNT Class A common stock as the asset contribution. Immediately following the asset contribution, FNF will convert all of its shares of FNT Class B common stock into shares of FNT Class A common stock and then distribute all of the shares of FNT Class A common stock that it owns, including the converted shares and the shares received from FNT pursuant to the securities exchange and distribution agreement, to holders of FNF common stock as a dividend, which we refer to as the spin-off. As a result, FNF stockholders will receive shares of our common stock representing, on a fullydiluted basis, approximately 85% of our outstanding common stock. After the completion of the spin-off, FNF will have no assets other than its approximately 50.5% ownership position in FIS, its ownership of FNF Leasing and its rights under certain agreements entered into pursuant to the securities exchange and distribution agreement.

Additionally, our certificate of incorporation will be amended to, among other things:

• increase the authorized number of shares of FNT Class A common stock from 300 million to 600 million;

• eliminate the FNT Class B common stock and all provisions relating thereto;

• remove all references to and any requirements resulting from FNF’s ownership of FNT common stock; and

• change our name to “Fidelity National Financial, Inc.”

We refer to the amendments to our certificate of incorporation as the charter amendments. Further, we will amend the FNT 2005 Omnibus Incentive Plan, which we refer to as the omnibus incentive plan, to increase the number of shares available for grants thereunder by 15.5 million. Following the completion of the proposed transactions, our common stock will be listed and traded on the

New York Stock Exchange, which we refer to as the NYSE, under the symbol “FNF.”

Tuesday, September 26, 2006

We Want Our Money Back!

Suits Claim Excessive 401(k) Fees at 7 Firms

By Kathy M. Kristof Times Staff Writer

September 26, 2006

Seven of the nation's largest companies violated pension laws by allowing their employees to be overcharged by the outside firms running their 401(k) retirement plans, according to a series of civil lawsuits.The employees were charged millions of dollars in excessive management fees, which often were hidden in obscure agreements and not disclosed to the workers, the suits allege."At best, these fee structures are complicated and confusing when disclosed to plan participants," claim all the suits, which were filed this month by attorney Jerome Schlichter in federal district courts in Illinois, California, Connecticut and Missouri. "At worst, they are excessive, undisclosed and illegal."

"In its Retirement at Risk series last spring, The Times reported that hidden fees were quietly eroding the 401(k) nest eggs held by 44 million American workers, and that many companies pay little attention to the costs. Employee benefits experts say suits targeting 401(k) costs are rare but could become more common as companies increasingly scale back their traditional pension plans — making earnings from 401(k)s more crucial

In 401(k) plans, employees contribute a portion of their earnings to an investment fund, often with a matching contribution from their employer. The employee is typically given the option of investing in a variety of mutual funds, which charge fees to invest and manage the money.

The lawsuits focus on so-called revenue sharing deals, in which the mutual funds chosen for corporate 401(k) plans return a percentage of the management and investment fees they earn to the outside administrators who run the plans and determine which funds will be offered.

These revenue sharing arrangements were not disclosed to participants, the suits allege, and the costs charged for them have far exceeded what is reasonable to manage the accounts.

Shareholders Want More Say

Boards of Directors are supposed to represent shareholders. There is a valid perception by many small fish shareholders that public companies are often controlled by an "Old boy network" who are less than diligent when looking out for the small investors. Sometimes these boards are referred to as "lap dogs".

When proposals like this get publicized, the company spokespeople usually try to argue that the shareholders interests wouldn't be served if a shareholder's representative was nominated. Okay.

Wall Street Journal, Sept 26, pg A2:

"Hewlett-Packard Co. should overhaul its board in the wake of the leak-investigation scandal, corporate-governance experts say, and four public pension funds are proposing a way for shareholders to help do that.

The four funds -- representing public workers in Connecticut, New York, North Carolina and Washington, D.C. -- said they filed a proposal asking H-P to change its bylaws to allow any shareholder group holding 3% of the company's stock for at least a year to nominate one or more board candidates.

Backers of the proposal are the New York State Common Retirement Fund, the Connecticut Retirement Plans and Trust Funds, the North Carolina Retirement Systems and the American Federation of State, County and Municipal Employees Pension Funds. Their proposal relies partly on a recent appeals court ruling that sided with AFSCME."

Monday, September 25, 2006

Teachers getting squeezed

It seems that "one" of the reasons for the county budget short-fall was a lawsuit won by commercial property owners. The commercial property owners claimed their taxes were too high when compared to business loss from 9/11. Not sure how that works. Are commercial property taxes tied to business revenues? Will have to find info on the lawsuit. Generally speaking what is going to happen to entities that depend on property taxes when property values go down? The news is full of stories about a housing slowdown. Anyways here is link to full story. Again need to find out more about lawsuit

Saturday, September 23, 2006

Living Small

Automobiles:

It is no longer trendy to drive an SUV.

Housing:

Sales of McMansions have rolled over.

Mark Vassallo, author of "The Barefoot House" says: "In a lot of cases, houses are not fitting the way people live anyway. People feel isolated from each other. We're all only so big, and human scale is so important. We won't find such a shock upon shifting to a smaller house if we admit we need one good space to watch TV, perhaps not three."

Food:

McDonalds stopped supersizing two years ago. More restaurants are offering smaller or half portions.

Friday, September 22, 2006

A Mutual Fund Fee That Is Actually Good

Market timing involves having favored investors rapidly trading in and out of mutual funds to profit from price differences. This hurts long term shareholders by diluting shares and increasing management fees.

The 22c-2 rule is designed to create a financial penalty for Sharks trying to profit at the expense of long term shareholders. It directs the mutual fund boards (who are supposed to be looking out for the shareholders) to consider imposing a "redemption fee" of up to 2% on any redemptions that take place within one week of buying the shares. Since nearly all long term investors will hold shares for longer than one week, they will not have to pay this fee. Actually, any proceeds of the fee are paid to the other shareholders.

According to today's Wall Street Journal, at least one third of mutual funds will not ready to meet all the requirements of 22c-2. They are having trouble with the requirement to have written agreements with brokers to receive information about potential short term trading.

So there are a few kinks; but overall this is a positive step forward for the average mutual fund shareholder.

Thursday, September 21, 2006

Who Is Charles Ponzi, and Why Do I Care

This is Charles Ponzi.

This is Charles Ponzi.He was born in Italy in 1886. He arrived in the U.S. in 1903 with $2.50 in his pocket.

He was one of the greatest swindlers in the history of the United States; and that is saying a lot.

If there were a Con-man Hall of Fame, he would be it's Babe Ruth.

His name has become synonymous with a particular type of scheme that is as popular today as it was in Ponzi's heyday, if not more so.

So, why should I care? Because running a Ponzi scheme is very, VERY lucrative for the perpetrator. It prays on people's greed and love of fast, easy money. The problem is that most of the people that get lured into these schemes get burned. They lose money. And in the end, they feel duped. There are countless variations on the Ponzi or Pyramid scheme. It is related to the greater fool theory.

You WILL be exposed to Ponzi schemes. There are new ones being created all the time. It is very tempting to get sucked into them because it appears to be easy money. It almost certainly is not, unless you are on the inside (in which case you will likely go to jail and pay it all back, if caught). Do yourself a favor and go to Vegas instead. At least they take your money legally.

The Ponzi scheme works like this (from museumofhoaxes.com):

"A Ponzi, or pyramid, scheme involves luring in investors with promises of high returns. The con artist makes up some story to explain how the high returns are generated, but in reality he simply pays the first investors with money obtained from later investors. It's a take-from-Peter-to-pay-Paul system. As long as the scam artist manages to recruit larger and larger numbers of new investors (aka suckers) it'll work, but as soon as the flow of new money stops, it collapses. And Ponzi schemes always collapse, sooner or later.

Ponzi's bait to lure in investors was the idea that postal coupons purchased in Europe could be redeemed in America for six times their value, because of the difference in currency values. He established a company in late 1919 to take advantage of this discovery and invited people to invest with him, promising them that his scheme was so lucrative that they would double their money in ninety days. On paper Ponzi's postal-coupon idea was plausible. But in practice his idea was completely hare-brained. It would have involved teams of agents buying up postal coupons in Europe, shipping them to America, and then taking them down to the post office to redeem them, one at a time. The cost of paying all these agents would quickly have eaten up any profits. Plus, for his idea to work he would have needed to redeem millions of postal coupons, but there were only a couple thousand of them in circulation.But, of course, Ponzi had no intention of actually putting his idea into practice. He just wanted as many people as possible to give him their money, and then let the pyramid scheme system go into effect.

And give him their money they did. At first people were skeptical, but when he actually began paying out returns to the early investors, a Ponzi-mania set in. Everyone wanted to give him their money. Thousands of people were lining up to give him cash. It's said that he had over 40,000 investors, allowing him to rake in somewhere in the region of $15 million by mid 1920.The inevitable crash arrived later in 1920 when newspapers and banks started to investigate him. Rumors of his criminal past emerged. Investors panicked and began withdrawing their money from his company. This caused the entire scheme to come crashing down like a house of cards.

Oddly enough, Ponzi didn't simply take the money and run. If he had been smarter, he would have. Instead he waited around until the police arrived and ended up being sentenced to five years in jail, of which he served three-and-a-half years.Ponzi spent the rest of his life drifting in and out of trouble with the law. He died in Rio de Janeiro on January 18, 1949, penniless."

Monday, September 18, 2006

Gimme What You Got

You can arm yourself, alarm yourself

You can arm yourself, alarm yourselfBut there's nowhere you can run

'Cause a man with a briefcasecan steal more money

Than any man with a gun

I said gimme, gimme what you got

-Don Henley

The cost of stock options is paid by shareholders of a company. The shareholders pay the cost with the understanding that these rewards motivate the management and employees of a company to perform well. It is a win/win scenario, in theory.

Options give their recipients the right to purchase shares at a fixed price, usually the market price on the date of the grant. Backdating involves pretending that a grant was made earlier than it really was, when prices were lower.

Here's the scam. Let's say I am CEO of UnitedWealth, Inc., and I am granted an option for 10,000 shares. Today's stock price is about $50. But instead of setting the price at today's market price, it is set to the price last June, when it was $40. My options are already $10 "in the money", before I even start. That is $100,000 bonus for doing nothing.

Stock options backdating is a way of skimming more profits away from shareholders.

Here is the list of 115 companies currently under scrutiny for stock option manipulation. If you own mutual funds or other pooled assets, or your retirement fund owns equities, it is possible you own some of these stocks and that these theives were taking money from your pocket without you even knowing about it.

Today's news:

Wall Street Journal, Sept 20, page A17

Monster Worldwide Inc. suspended its general counsel and Broadcom Corp.'s finance chief retired ahead of schedule, as the fallout from the options-manupulation scandal continued to spread.

Both Monster and Broadcom have disclosed problems with their stock-options accounting. Earlier this month, Broadcom doubled its estimate of the hit to its books, suggesting it will make a restatement to increase its past expenses by more than $1.5 billion.

In a short statement, Monster said lontime general council Myron Olesnyckyj was suspended "effective immediately" though it didn't say precisely why. Broadcom said William J. Ruehle "decided to accellerate his retirement".

At many companies, general councels are responsible for supervising aspects of the options-granting process, while finance chiefs typically supervise how grants are accounted for.

Saturday, September 16, 2006

Who Pays the Piper?

Awarding options is a way to motivate employees and managment to work extra hard to make a company profitable. More profit=higher stock price=higher option value. On the surface, this makes sense. Work hard, perform, deliver results, reap rewards. Everyone wins!

So how does it work?

Let's say, for example that I work for Giggle (the purely fictitious Internet search company), and two years ago and I was awarded 10,000 stock options at the price of $120 per share. I don't actually buy the shares; I have an option to buy them at a set price, within a specified time period. Using a complex Giggle algorithm, it quickly becomes obvious to me that every dollar increase in the price of the stock puts $10,000 in my pocket. If the stock goes down in price, I lose nothing. Overall, there is no risk for me.

So two years go by, during which I have worked many hours and helped Giggle to dominate the Internet advertising space. All this accelerating ad revenue has caused the stock price to skyrocket to $420, so I decide to exercise my option. I buy 10,000 shares at $120 per share and simultaneously sell those 10,000 shares at $420 per share. My net profit is $3 million, less transaction fees and taxes. Yee-ha!

So where does that $3 million come from?

Good question.

To give someone something, it is usually necessary that you own it. Therefore, the company, Giggle in this case, needs to actually own some of it's own stock to sell to me. If they don't own stock, they would have to buy some at the market rate.

Option 1:

Already own the stock.

Giggle takes shares that it could sell on the open market for $4.2 million and sells it to me for $1.2 million. Net result is that I am $3 million richer and the company is $3 million poorer.

Option 2:

Have to buy stock.

Giggle buys stock for $4.2 million and sells it to me for $1.2 million. Net result is that I am $3 million richer and the company is $3 million poorer.

Now $3 million may sound like a lot of money, but Giggle has 300 million shares outstanding, so it is really only about a penny per share. Small price to pay for all that increased motivation and performance. But wait a minute, you may ask. What if Giggle has 1,000 employees, each with 10,000 options. That works out to $3 billion in payouts. That seems a bit excessive, doesn't it?

Well, the shareholders are in luck. There is a highly qualified Board of Directors looking out for the shareholders interests! The Board would never stand for excessive spending on stock options. They say "Options are good. Besides, our competitors are doing it so if we don't join in, all our good managers might go work for Mister Softey or Yoyo". For doing such a good job of looking out for the shareholders, the company issues more options to the directors, which the directors then duly approve.

It turns out that most of the shareholders are mutual funds and institutions. Many individuals own the stock in retirement and investment accounts. They trust the fund managers to look out for their best interests. The mutual funds also have Boards of Directors (affectionately known as "lap dogs") that are diligently looking out for the interests of the individual mutual fund holders.

In a perfect world, the amount a company spends on stock options would be more than offset by increased productivity and performance due to highly motivated employees and company management. When options get out of hand, and greed takes over, it is the shareholders that ultimately pay the price.

Buy real estate with your IRA

What is a self-directed IRA? It's simply an Individual Retirement Account established with a broker instead of a mutual fund or a bank. A self-directed IRA enables you to buy and sell individual stocks, mutual funds and real estate. As a result, you make the investment decisions instead of someone else, such as the manager of a mutual fund.

A great way to get started with a self-directed IRA is to roll over your 401K into a self-directed IRA. You can roll over your 401K when you terminate your employment. So if you are looking to change employers keep in mind this is a wonderful opportunity to roll your 401K into a self-directed IRA.

For me buying real estate is the most appealing aspect of a self-directed IRA. Remember banks, brokerage firms, and other companies that administer most IRAs are not interested in helping folks buy real estate because they want to sell their own products. About 10 years ago I changed jobs and decided to open a self-directed IRA. My motivation was to take care of my disabled brother. My goal was to purchase home for my brother. There are some restrictions about who can be the owner of property bought through a self-directed IRA. For instance the following would be excluded from owning real estate under and IRA.

- The IRA owner

- The IRA owner's spouse, descendant (e.g., son), or ascendant (e.g., mother)

- Spouse of a descendant of the IRA holder

I shopped around for an IRA custodian that offered self-directed IRA. Ten years ago the pickings were pretty slim. I decided to go with a Pensco because they were local (San Francisco) and I really like the way they answered my questions and their supporting documentation. I ended up rolling my 401K into a self-directed IRA help by Pensco. I bought my brother a home in North Carolina and can now sleep a little better at night knowing my brother will always have a roof over his head.

Conclusion: There is a reason your IRA has limited investment choices. There is an alternative and it is called a self-directed IRA. With a self-directed IRA you can buy real estate today with tax deferred dollars. I encourage you to read up on the self-directed IRAs.

NYSE Targets Brokers & Supervisors

"Now, we're beginning to focus on the individual brokers who were facilitating

market timing of customers, and we're looking at supervisors of those

brokers,"GO MS. MERRILL!

The mutual fund market timing scandal first came to light in 2003 and has resulted in settlements, before the Prudential settlement, of more than $3.5 billion. Market timing costs long term holders of mutual funds through dilution of share value and increased transaction costs.

Following is an edited copy of the NYSE news release

NEW YORK, August 28, 2006 – NYSE Regulation, Inc. announced today that it has censured and ordered Prudential Equity Group, a member firm, to disgorge $270 million for fraudulent market timing in connection with the trading of mutual fund shares.

“It is absolutely unacceptable to see the level of knowledge and acquiescence by senior managers of such pervasive deception by Prudential’s market-timing brokers,” said Susan L. Merrill, chief of enforcement, NYSE Regulation, Inc. “The disgorgement of $270 million will compensate the funds’ shareholders. The action is also evidence of tremendous cooperation by securities regulators working together to ensure that a brokerage firm cannot profit from condoning fraud.”

Prudential has been ordered to pay a total of $600 million. $270 million will be paid to a distribution fund administered by the SEC for the benefit of those harmed by the fraud, $325 million will be paid to the U.S. Department of Justice, and $5 million will be paid as a civil penalty to the Massachusetts Securities Division. “Market timing” includes frequent buying and selling of shares of the same mutual fund or buying or selling of mutual fund shares in order to exploit inefficiencies in mutual fund pricing. Though not illegal per se, market timing can harm mutual fund shareholders because it can dilute the value of their shares, if the market timer is exploiting pricing inefficiencies, or disrupt the management of the mutual fund’s investment portfolio and can cause the targeted mutual fund to incur costs borne by other shareholders to accommodate frequent buying and selling of shares by the market timer.

To prevent market timing, mutual funds have placed restrictions on excessive trading in their prospectuses and monitor for excessive short-term trading by reviewing brokers’ and customers’ account numbers, trade size, principal amount, and branch codes.

From September 1999 and continuing through at least June 2003 brokers at Prudential used deceptive trading practices to conceal their identities, and those of their hedge fund customers, in order to evade prospectus limitations on market timing. At least 50 mutual funds and their long-term shareholders were defrauded. The firm profited from this misconduct because the brokers generated approximately $50 million in gross commission revenues as a result of this misbehavior.

The deceptive practices included the use of: 1) multiple broker identifying numbers; 2) multiple customer accounts; 3) accounts coded as “confidential”; and 4) “under the radar” trading. The practice of “under the radar” trading refers to the splitting of one trade into numerous smaller ones to avoid detection.

As early as the fourth quarter 1999, several mutual fund companies identified the use of deceptive trading practices and notified Prudential. In May 2002, the firm itself determined that its top-producing broker used deceptive practices to avoid notice by mutual funds. Ultimately, the firm received hundreds of notices from mutual fund companies that identified the misconduct and asked Prudential to take steps to curtail the activity.

Despite increasing awareness of the brokers’ fraudulent activities, the firm elected to continue the business of market timing. Instead of disciplining or sanctioning any of the brokers, or even curtailing their ability to open additional accounts for their market timing customers, Prudential failed to prevent their misconduct from continuing and actually began to track the brokers’ gross revenues.

For example, in 2001, the brokers generated more than $16 million in gross commission revenues for the firm, most of which was in danger of being eliminated had the firm phased out market timing at that time. Similarly, approximately $23 million in gross commission revenues were generated in 2002, and comparable revenues continued to be generated until June 2003.

The firm’s policies and procedures were ineffective and largely not enforced. Even in situations where the firm purportedly enforced any of these policies, its senior officers undermined the policies by granting exceptions for the largest producing brokers. Additionally, Prudential repeatedly failed to prevent the inappropriate use of hundreds of broker identifying numbers, even though the use of multiple numbers was the primary means of concealment by which the brokers carried out their fraud. Prudential finally issued a market timing policy in January 2003, but the firm did not fully enforce procedures in that policy to end the scheming.

Friday, September 15, 2006

Asking Questions

From the SEC website:

Ask Questions

That's the best advice we can give you about how to invest wisely. We see too many investors who might have avoided trouble and losses if they had asked basic questions from the start.

We encourage you to thoroughly evaluate the background of any financial professional with whom you intend to do business—before you hand over your hard-earned cash. It doesn't matter if you are a beginner or have been investing for many years, it's never too early or too late to start asking questions. It's almost impossible to ask a dumb question about how you are investing your money. Don't feel intimidated. Remember, it's your money at stake. You are paying for the assistance of a financial professional."

One suggestion is to us this form as a guide for questions to ask anyone recommending you buy or sell an investment. There is a fairly simple complaint process that appears to be taken quite seriously by the commission. They will even send you information on mediation, arbitration and finding a lawyer, if it gets that far; hopefully recover your stolen money.

Thursday, September 14, 2006

Exxon Workers Recover Lost Retirement Money

Louisiana federal judge has upheld a $22 million award to 32 former Exxon Mobil Corp. workers who said a broker put their retirement money into inappropriate, risky investments.

The broker's former employer, Securities America Inc., may appeal U.S. District Judge Jay Zainey's order that it pay $8.2 million in attorney's fees and punitive damages as part of the award, said Paul Johnson, a spokesman for Securities America's parent, Ameriprise Financial Inc.

In a related proceeding, brokerage regulator NASD on Thursday fined Securities America an additional $2.5 million for failing to supervise the former broker, David McFadden, and ordered it to pay $13.8 million that had been part of the May arbitration settlement in restitution to the former Exxon workers.

According to the NASD, McFadden would lure Exxon workers, typically ages 50 to 60, into moving retirement money into investments he recommended, with "unreasonable and exaggerated promises of high returns."

Ameriprise Settlement

Urban Car Sharing

The major car rental companies don't appear to have much visibility in this seemingly growing market. Maybe they are too busy with IPO's and financial engineering to have time to develop new business.

If I lived and worked in the city, I would definitely consider getting rid of my car and using one of these services. No car payments, no insurance payments, no maintenance, registration, gas, parking. All covered in one pay as you go fee. Nice idea.

I think it would be fun to share a Porsche once in a while. I didn't see any available, though.

Zipcar http://www.zipcar.com/

Citycarshare http://www.citycarshare.org/

Flexcar http://www.flexcar.com/

Wednesday, September 13, 2006

It Pays To Be Second

"When I first started out in the executive pay field more than 45 years ago, some CEOs of major companies suggested: ``Why you could double my pay, and it would get lost in the rounding.''

Maybe so then, but not today. And that's especially the case when giving the CEO an extra dollar may end up costing the shareholders $30 or $40 extra dollars because of the magnetic effect the CEO's pay package has on his top subordinates.

That's why it's so important for shareholders to stand up and object when they see a CEO getting a bomb of money without producing anything extra for them."

Hedge Hogs

Jeff Marwil, the trustee liquidating failed hedge fund Bayou Managment has filed a lawsuit against investors who got out before it collapsed. Marwil says that people inside Bayou may have given certain investors information, motivating them to cash out.

"Bayou essentially used money from new investors to pay old investors. When the plan collapsed, some $250 million was unpaid." - WSJ

"NEW YORK (CNNMoney.com) -- The bankruptcy court trustee for failed hedge fund Bayou Management is reported to be suing investors who got out of Bayou before it collapsed, including an investment fund that includes New York Mets owner Fred Wilpon.

TheWall Street Journal reports the trustee, Jeff Marwil, has filed more than 120 complaints in recent months, seeking to reclaim not only the initial investments but also the profits of investors who cashed out.

Collectively the suits seek $150 million, the paper reports. Among the defendants in the suit is Sterling Stamos, an investment fund in which Wilpon is a partner. In a statement to the paper, Sterling Stamos said it had no knowledge of the fraud committed by Bayou's principals and would vigorously fight the suit.

The founders of Bayou pleaded guilty to fraud, the paper reports, essentially using money from new investors to pay old investors. When the plan collapsed, some $250 million was unpaid, it said.

The paper reports that Bayou's investors aren't accused of fraud but that people inside Bayou may have given certain investors information, motivating them to cash out. Marwil told the paper that Bayou investors being sued must prove that they had no knowledge of fraud in order to use the "good faith" defense."

CNN Money

Mutual Fund Hidden Fees

Unlike sales loads, which are charged only once at the purchase or the sale of shares, 12b-1 fees are taken from your account continually. So while a 1% 12b-1 fee may seem a lot less worrisome than a sales load of 8.5%, you may well end up paying more in 12b-1 fees if you hold mutual fund shares over the long term. Furthermore, because 12b-1 fees are generally taken from the income distributions your mutual fund pays to you, you may well not even notice how much you're paying for the fee. While you can find a description of general fund fees and expenses in every fund prospectus, you won't get an itemized bill from your mutual fund explaining exactly how much money you paid for each type of fee. Because they are difficult to calculate and easily concealed, 12b-1 fees are sometimes referred to as hidden loads.

Tuesday, September 12, 2006

Reach for the Sky

I was at Yosemite yesterday climbing Half Dome. 17 miles and about 4,500'. Standing on top is like being on top of the world.

Photo's do not do this place justice.

Ansel Adams has come closest to capturing the spirit Adams link

Sunday, September 10, 2006

Mutual Admiration

"And we don't believe in pushing investments just because they're trendy or someone says they're hot. We're committed to looking out for your best interests and helping you develop a plan that makes sense for your specific goals."

From AP, August 31, 2006:

ST. LOUIS (AP) -- Edward D. Jones & Co. has signed a tentative $127 million settlement in nine class action lawsuits for questionable revenue-sharing and sales practices from 2004, the brokerage firm announced Thursday.

The St. Louis-based company is still awaiting a U.S. District Court judge's approval on the settlement. It would return $55 million in cash to customers and cover legal fees. It would also provide $72.5 million in non-cash vouchers to current clients over three years.

In December 2004, the Securities and Exchange Commission finished its investigation of the brokerage firm and found that the company created a conflict of interest by failing to disclose to its customers a revenue-sharing deal with mutual-fund companies.

Soon after, in a separate settlement, then-U.S. Attorney James Martin announced a $75 million deal with Edward Jones to avoid criminal charges from the Justice Department.

That money is expected to be distributed in September to Edward Jones customers in a Fair Fund, separate from the class action settlement.

"We believe the 2004 settlement agreement with regulators addressed all the relevant concerns regarding this issue," Edward Jones managing partner James Weddle said in a statement. "However, because we do not believe our clients, our associates or our firm would benefit from a prolonged legal battle we've decided to settle the class actions suits."

Edward Jones did not admit to wrongdoing and has since agreed to disclose and tell customers about revenue-sharing agreements on its Web site.

Edward Jones had revenue-sharing deals with seven mutual-fund companies that were in question; including Goldman Sachs, Federated, American, Putnam, Van Kampen, Lord Abbott and Hartford.

In exchange, Edward Jones designed those mutual funds as Preferred Fund Families with special benefits given to those companies.

Brokers were encouraged to sell those mutual funds to customers, the SEC claimed.

Pig in a Python

The front edge of the baby boom generation has now reached their 60's. With retirement of 70 million or so boomers in America, what could happen?

Some intelligent insight can be found here

No Cuts, No Butts, No Coconuts

Saturday, September 09, 2006

Did you say Trillion?

Washington, DC, August 30, 2006 - The combined assets of the nation's mutual funds increased by $40.30 billion, or 0.4 percent, to $9.377 trillion in July, according to the Investment Company Institute's official survey of the mutual fund industry. In the survey, mutual fund companies report actual assets, sales, and redemptions to ICI.

More details here

Inspiration from Omaha

Imagine for a moment that all American corporations are, and always will be, owned by a single family. We'll call them the Gotrocks. After paying taxes on dividends, this family -- generation after generation -- becomes richer by the aggregate amount earned by its companies.

Today that amount is about $700 billion annually. Naturally, the family spends some of these dollars. But the portion it saves steadily compounds for its benefit. In the Gotrocks household everyone grows wealthier at the same pace, and all is harmonious.

But let's now assume that a few fast-talking Helpers approach the family and persuade each of its members to try to outsmart his relatives by buying certain of their holdings and selling them certain others. The Helpers -- for a fee, of course -- obligingly agree to handle these transactions. The Gotrocks still own all of corporate America; the trades just rearrange who owns what.

So the family's annual gain in wealth diminishes, equaling the earnings of American business minus commissions paid. The more that family members trade, the smaller their share of the pie and the larger the slice received by the Helpers. This fact is not lost upon these broker-Helpers: Activity is their friend, and in a wide variety of ways, they urge it on.

After a while, most of the family members realize that they are not doing so well at this new "beat my brother" game. Enter another set of Helpers. These newcomers explain to each member of the Gotrocks clan that by himself he'll never outsmart the rest of the family. The suggested cure: "Hire a manager -- yes, us -- and get the job done professionally."

These manager-Helpers continue to use the broker-Helpers to execute trades; the managers may even increase their activity so as to permit the brokers to prosper still more. Overall, a bigger slice of the pie now goes to the two classes of Helpers. The family's disappointment grows. Each of its members is now employing professionals. Yet overall, the group's finances have taken a turn for the worse. The solution? More help, of course.

It arrives in the form of financial planners and institutional consultants, who weigh in to advise the Gotrocks on selecting manager-Helpers. The befuddled family welcomes this assistance. By now its members know they can pick neither the right stocks nor the right stock pickers. Why, one might ask, should they expect success in picking the right consultant? But this question does not occur to the Gotrocks, and the consultant-Helpers certainly don't suggest it to them.

The Gotrocks, now supporting three classes of expensive Helpers, find that their results get worse, and they sink into despair. But just as hope seems lost, a fourth group -- we'll call them the hyper-Helpers -- appears. These friendly folk explain to the Gotrocks that their unsatisfactory results are occurring because the existing Helpers -- brokers, managers, consultants -- are not sufficiently motivated and are simply going through the motions. "What," the new Helpers ask, "can you expect from such a bunch of zombies?"

The new arrivals offer a breathtakingly simple solution: Pay more money. Brimming with self-confidence, the hyper-Helpers assert that huge contingent payments -- in addition to stiff fixed fees -- are what each family member must fork over in order to really outmaneuver his relatives.

The more observant members of the family see that some of the hyper-Helpers are really just manager Helpers wearing new uniforms, bearing sewn-on sexy names like HEDGE FUND or PRIVATE EQUITY. The new Helpers, however, assure the Gotrocks that this change of clothing is all-important, bestowing on its wearers magical powers similar to those acquired by mild-mannered Clark Kent when he changed into his Superman costume. Calmed by this explanation, the family decides to pay up.

And that's where we are today: A record portion of the earnings that would go in their entirety to owners -- if they all just stayed in their rocking chairs -- is now going to a swelling army of Helpers. Particularly expensive is the recent pandemic of profit arrangements under which Helpers receive large portions of the winnings when they are smart or lucky, and leave family members with all the losses -- and large fixed fees to boot -- when the Helpers are dumb or unlucky (or occasionally crooked).

A sufficient number of arrangements like this -- heads, the Helper takes much of the winnings; tails, the Gotrocks lose and pay dearly for the privilege of doing so -- may make it more accurate to call the family the Hadrocks. Today, in fact, the family's frictional costs of all sorts may well amount to 20 percent of the earnings of American business. In other words, the burden of paying Helpers may cause American equity investors, overall, to earn only 80 percent or so of what they would earn if they just sat still and listened to no one.