Sunday, March 02, 2008

City of Vallejo considering bankruptcy

that explains the general cause of the Vallejo's financial crisis.

With the down turn in the realestate market and job market I doubt Vallejo will be the only city in California that will have to consider bankruptcy.

Told you so

Well more than a year later it seems like we were onto something

Take a look at this Americans are 'financially illiterate' - survey from CNN Money

Saturday, February 24, 2007

Wednesday, February 14, 2007

Tuesday, February 13, 2007

The Science of Getting Rich - for free!!

http://project.jtchandler.com/

I downloaded the audiobook for free from Califa

All you need is a library card.

Defer Capital gains on sale of primary residence

Tax-free exchange that allows a seller two years after escrow closes on his former principal personal residence to buy like-kind property and defer taxes. Profits from the sale of a principal residence are not taxed if, essentially, the purchase price of the new residence is equal or greater than the sales price of the old residence. Also, the new residence must be acquired and personally occupied within 24 months before or after the sale of the old residence, for a 48-month period. To accurately set the amount of profit deferred, the net sales price and adjusted sales price of the old residence must be calculated. From these respective figures are derived the actual profit and minimum purchase price of the new residence to fully avoid taxes on the profit. The 24-month sale-to-replacement period offers the homeowner the opportunity to use the net sales proceeds from the old residence for short-term, high-yield money market investments. These investments are liquid and generally more lucrative than real estate acquisitions during periods of high interest rate.

Thursday, February 01, 2007

Americans are spending too much

WASHINGTON (AP) - People once again spent everything they made and then some last year, pushing the personal savings rate to the lowest level since the Great Depression more than seven decades ago.

The Commerce Department reported Thursday that the savings rate for all of 2006 was a negative 1 percent, meaning that not only did people spend all the money they earned but they also dipped into savings or increased borrowing to finance purchases. The 2006 figure was lower than a negative 0.4 percent in 2005 and was the poorest showing since a negative 1.5 percent savings rate in 1933 during the Depression.

Friday, January 05, 2007

Housing Inventory Snapshot

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||

Wednesday, December 27, 2006

Investment club for San Mateo

6:30 pm, (sharp)

393 Vintage Park Dr.

Suite 220

Foster City, CA. 94404

Map: http://tinyurl.com/yesb95

We are starting a PennyJar Investment Club in San Mateo and we would be thrilled to have you join us to find out more about what PennyJar is all about! Our first meeting is January 8, 2007. The location has lots of free parking and is easy to get to; just off highway 92.

Why US $ is going down: Central Banks buying Euros

Below is excerpt from news today

Reports that the United Arab Emirates would diversify its foreign currency reserves by purchasing more euros provided the currency-moving catalyst. Traders viewed the move as symptomatic of a wider trend and quickly bid up the euro.

"By itself, the UAE's shift is small change in the foreign-exchange market," Tony Crescenzi, chief bond market strategist at Miller Tabak and a RealMoney.com contributor, wrote in a published article. But "the UAE's shift is another in a string of actions taken by the world's central banks" to diversify away from the dollar.

source: the street.com http://www.thestreet.com/_iwon/markets/metals/10329783.html?cf=WSIWON1111051500

Saturday, December 09, 2006

Friday, December 08, 2006

Someone tried to Scam me on Craigslist

Then I got this email, which smelled very bad to me:

Hi Paul,

How are you doing.Hope everything is going fine on your side, As a matter fact the deal is on and according to my secretary,he has already sent the check out to you.So the payment should arrive in a short while from now.And once you get it,i guess you know how to handle everything.And please dont bother about any other buyers.But there was a little problem which i guess we can handle with understanding.When i contacted my secretary to know maybe the payment as already been sent,i got to know that there was a misinterpretation while sending the payment.According to the instruction i gave him,he was suppose to have send you a check of $140.But instead,he sent a check of $1400. It was a terrible mistake and the check is already out for delivery to your location.But that should not disturb our own transaction.the deal is on and we will get through it.what will happen is that ,once you get the check you will take it to the bank and cash it immediately,then you deduct your $140, and a $25 dollars for your run around in cashing the check and also a $100 for sending the rest funds to my mover via western union money transfer that same day,my mover will be using the remaining funds for the pick up,i guess i can be assured in you that you can handle it with trust and have it sent to my mover.E-mail me back immediately to let me know that i can trust you to handle everything well.I will be expecting your e-mail asap.PLS AM PUTTING MY TRUST IN YOU.

Best Regards

and Stay Blessed.

Ken.I went to internet crime complaint center and found a description on COUNTERFEIT CASHIER'S CHECK. Basically, they get victims to wire money overseas via Western Union, after they think the check has cleared, but it really hasn't.

Then I called Wells Fargo to get advice on how to proceed, or not. They told me that the scammers work outside the country and they are getting away with it. They referred me to the Internet Crime Complaint Center. Unfortunately, the ICCC only keeps track of victims and are not proactive. They don't actually investigate, only keep statistics. Great.

I cancelled the deal. From now on I deal in cash only.

I can't help but think that a lot of people are falling for this crap.

Friday, December 01, 2006

How the Dollar System works

Thursday, November 30, 2006

Dizzy Dollar Data

In recent days, the "collapse" of the US dollar has been getting some headlines. A benchmark of the dollar is called the Dollar Index. It is an index created by the New York Board of Trade. It takes a basket of currencies and compares them to the US dollar. These currencies are "weighted", i.e. some have more effect than others on the index.

The currencies, and their respective weightings are:

Euro 57.6%

Yen 13.6%

Pound 11.9%

CAN dollar 9.1%

Swiss Franc 3.6%

Swedish Krona 4.2%

In theory, the NYBOT dollar index is trade weighted. That is to say the percentage of importance on the dollar index is a reflection of trade with America.

Well, I decided to look up the actual trade figures for last year, 2005.

Here's what I found.

- America's biggest trading partner was Canada. Almost $471 billion.

- America's second biggest trading partner was China. About $281 billion.

- All of Euro based Europe was somewhere over $300 billion.

Since the Euro makes up 57.6% of the index, one would think that we are doing a lot of trade with Europe. In fact, only about 11 or 12% of US trading activity is with (Euro) Europe. Canada, despite being weighted at 9.1% actually partners in 17% of US trade.

China isn't on the index. Neither is Mexico, which did over $270 billion in trade with the US. Korea and Taiwan combined did over $124 billion in trade. Also, you guessed it, NOT on the index.

Sweden and Switzerland, who make up 7.8% of the index did less than $39 billion last year, combined. That is a meagre 1.4% of US trade.

Perhaps the headline dollar index should be weighted to actual trade, not tied to some ratios that the NYBOT decides is reflective of the strength of the currency.

Bottom line is that headline numbers are often misleading. The dollar has fallen against the Euro and the Pound, but is that so bad, considering most of our foreign trade is done elsewhere? Maybe it hurts Europe more than America, particularly for tourism, airplanes and BMW's. Just a contrarian's view.

Simpler Times

Really sophisticated “investors” might have used some savings to buy securities, such as bonds or stocks. This was done with the help of a broker/advisor. There were a small number of mutual funds available to invest in. Some people bought investment properties with the intention of collecting rent (as opposed to flipping).

These days, there are so many, many choices for the individual, that it has become almost impossible for the average person to make any sense of it all. Many simply give up and surrender their money to multi-billion dollar management firms, which proceed to make outrageous amounts of profit from the management of your money, while your returns wallow in mediocrity.

Starting in January 2007, Pennyjar will be gathering small groups of individuals together to learn and gain confidence in personal finance and investing. These groups are in the form of an "investment club" but they will be much, much more than that. Our first groups will be in the San Francisco Bay area (since that's where we live).

It is important, to us, for people to be fully engaged in the process. For that reason, we will all have some "skin in the game". As a group we will be investing a small amount of money in real investments, be they stocks, bonds or some other product. Let's say, for the sake of argument, that each individual's minimum dollar comitment will be the equivavlent of about one Starbucks latte per week. Not too much, but it will be enough to make it interesting. The collective group of 10 or so members will decide on where the money gets specifically invested.

Pennyjar doesn't stop at being an investment club. We intend to make this process a lot of fun. By design, our meetings will be entertaining. There will also be a significant degree of social interaction. We are not interested in being a group of experts. Frankly, most of the supposed money "experts" are basically full of shit; they just know a lot of jargon and they know how to confuse people just enough so that they will be intimidated to hand over all thier money.

We are just regular people that want to get ahead and we agree that education and knowledge is the best path there. Better than lottery tickets, Amway, Vegas, dot.com stocks, pre-construction flips, and so on.

We are going to help people to help each other gain the knowledge and, we believe more importantly, the confidence to make good decisions. Pennyjar doesn't have all the answers, but we certainly will generate a lot of questions. And we will have a good time in the process.

We promise.

Sunday, November 19, 2006

How to pick a stock: The BUD example

Let's now turn our attention to analysing aka(understanding) ANHEUSER BUSCH (NYSE:BUD). Let's pretend we know nothing about buying stocks. What would be some of the things we would need to know? Well first what is a stock? When you buy a stock you are buying a piece of a company. Stock gives you partial ownership in a company. You become partners with the company. Your fortunes are tied to the company's success. It only seems logical then that you need to understand the company. Fundamental stock analysis is about understanding the company before you become a part owner in the company. O.K. what would I like to know about the company?

What does it do?

How does it make its money?

Can I go to sleep and know the company will still be there when I wake up?

Is the company profitable? (does it make more than it spends)

Does the company reward the stock holders by paying a dividend?

Who runs the company?

How effectively do the owners spend the stock holders money? Remember companies sell stock to raise money. What they do with this raised money is important to their business and your pockets.

Do we think the stock price will go up or down?

Getting the answers to these questions will help you decide if you should buy BUD.

The best place to look for the answer to our questions is Yahoo Finance. Here is the link to BUD at Yahoo Finance

What does it do? This can be found by clicking on profile link from Yahoo Finance. And here is where we find out that BUD "engages in the production and distribution of beer worldwide". This was not surprise (hopefully). We also find out "The Entertainment segment owns and operates theme parks. The company also is involved in the real estate development business; and owns and operates The Kingsmill Resort and Conference Center in Williamsburg, Virginia".

More I want more.. Let's visit www.hoovers.com to find out more about BUD. From Hoovers we find out that BUD owns a 50% stake in Mexico's top brewer, Grupo Modelo, which makes Corona and Negra Modelo among many other brands.

Let's stop here for now. Please look around the profile link. Can you tell me the name of the CEO and the income of th CEO? How many employees?

To be continued.........

Pardon me I just had a taxable event

Call me crazy, but I recently made an offer on a home in the San Francisco Bay Area. And yes I read the headlines and know there is a decline in the housing market. If you have read my earlier post you know that I am fond of the housing bubble logic presented at patrick.net. The house I made an offer on has been on the market for 6 months. The asking price has dropped $70K over those six months. While I think markets like Las Vegas and Reno will continue to drop in value, I am obviously less confident about bay area prices falling any further. So I made the leap of faith and sold some of my stocks to come up with the down payment. The selling of my stocks is a taxable event. I had to decided which stocks to sell. I basically broke my choices into two categories.

Call me crazy, but I recently made an offer on a home in the San Francisco Bay Area. And yes I read the headlines and know there is a decline in the housing market. If you have read my earlier post you know that I am fond of the housing bubble logic presented at patrick.net. The house I made an offer on has been on the market for 6 months. The asking price has dropped $70K over those six months. While I think markets like Las Vegas and Reno will continue to drop in value, I am obviously less confident about bay area prices falling any further. So I made the leap of faith and sold some of my stocks to come up with the down payment. The selling of my stocks is a taxable event. I had to decided which stocks to sell. I basically broke my choices into two categories.- Losers that I have held for less than a year

- Winners that I have held for more than a year.

Why?

If you've held a stock for at least one year, you're eligible for long-term capital-gains rates. Long-term capital gains are taxed at the 20% rate for most folks, while short-term gains--or gains made on stocks held for less than one year--are taxed at ordinary income tax rates, which range from 15% to 39.6%. In my case I am in the 33% tax bracket. So by selling the winners I have held for a year or more I am saving about 13% in taxes compared to selling winners I have held for less than a year. "begin sidebar" see the potential tax draw backs of day-trading? "end sidebar" I decided to sell the losers I have held for less than a year so that I can claim the losses on this years taxes to help offset some of the gains. If my offer is accepted on the home, I will not enjoy the mortgage interest deduction until I do my 2006 taxes.

Wednesday, November 15, 2006

Who owns stock

That said, does it really make sense to point at rich folks and blame them for your own current condition? Rather than blame, my strategy is to ask, "What are they doing?" and then do some of it. Blaming, or being a victim is disempowering. I find it more energizing to take some personal responsibility and change the habits that do not serve me well.

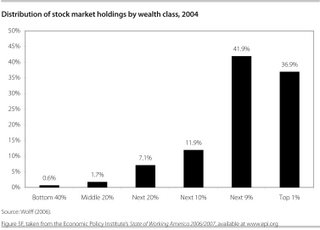

As you can see in the chart below, the top 10% weathiest people in America own roughly 80% of the stocks.

Maybe, if I want to be rich, I should know a little more about investing and stocks.

Maybe I should stop wasting my money on the latest gizmos, fashion trends or bling and put some of that money to work for me.

You think?